Education

The Ultimate Guide to Synthetic Covered Calls

by

Patricia

Oct 7, 2024

2

min read

Tired of Tracking Options Trades in a spreadsheet?

Try WingmanTracker Free for 30 Days

100% Money-Back Guarantee

Synthetic covered calls are an advanced options strategy that traders use to replicate the risk-reward profile of a traditional covered call without owning the underlying stock.

This strategy combines a short put and a long call option with the same strike price and expiration date, offering traders a way to potentially enhance returns while managing risk.

Understanding synthetic covered calls is crucial for options traders looking to expand their toolkit and optimize their trading strategies in various market conditions.

What is a Synthetic Call and how does it work?

Synthetic covered calls are a sophisticated options strategy that mimics the payoff of a traditional covered call without requiring ownership of the underlying asset.

This approach combines selling an at-the-money put option and buying an at-the-money call option with the same strike price and expiration date.

Traditional covered calls involve owning shares of a stock and selling call options against those shares.

This strategy generates additional income from option premiums while limiting potential upside gains.

Synthetic covered calls aim to achieve similar results using only options contracts, making it an attractive alternative for traders seeking capital efficiency.

Grasping synthetic strategies in options trading is essential for several reasons.

First, they allow traders to create synthetic positions that behave like other strategies but with different capital requirements or risk profiles.

Second, synthetic positions can offer increased flexibility in managing trades and adjusting to changing market conditions.

Finally, understanding synthetic strategies opens up new opportunities for traders to express their market views and potentially enhance returns.

As we explore synthetic covered calls, we'll examine their mechanics, advantages, risks, and practical applications.

This knowledge will equip traders with a powerful tool to navigate various market scenarios and potentially improve their trading outcomes in the stock market and options trading landscape.

Understanding the Basics

A synthetic position in options trading replicates the risk-reward profile of another position using different financial instruments.

These positions allow traders to achieve similar outcomes through alternative means, often with different capital requirements or tax implications.

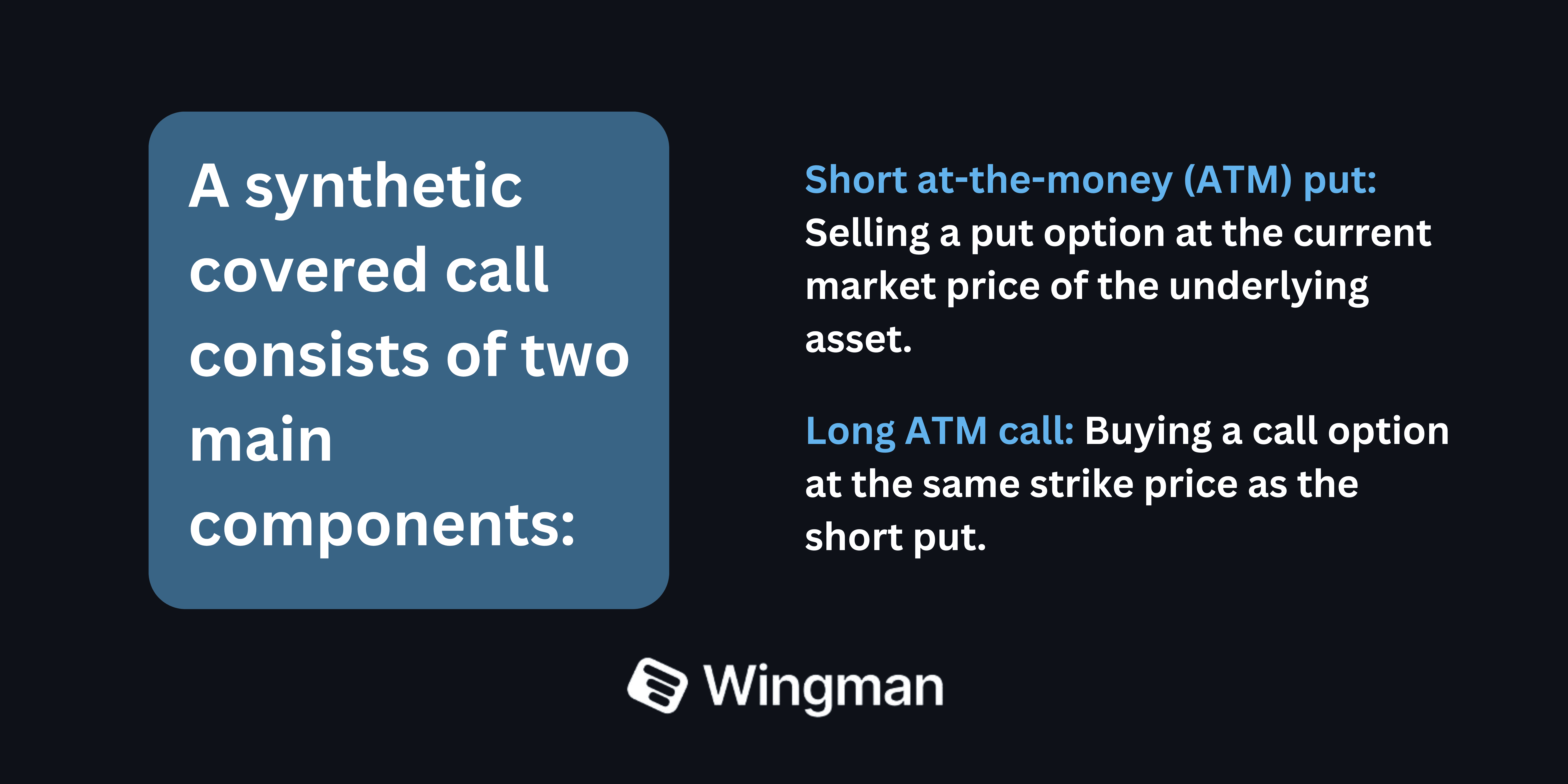

A synthetic covered call consists of two main components:

Short at-the-money (ATM) put: Selling a put option at the current market price of the underlying asset.

Long ATM call: Buying a call option at the same strike price as the short put.

Both options have the same expiration date, creating a position that behaves similarly to a traditional covered call.

Synthetic covered calls replicate traditional covered calls by combining the profit potential of a long stock position (simulated by the long call option) with the income generation of a short call position (achieved through the short put option).

The short put creates an obligation to buy the stock at the strike price if assigned, while the long call provides upside potential if the stock price rises.

This strategy allows traders to benefit from potential stock price appreciation and generate income from option premiums without actually owning the underlying stock.

The synthetic nature of the position offers flexibility and potentially lower initial investment compared to traditional covered calls, making it an attractive options strategy for many investors seeking to optimize their investment strategy.

The Mechanics of Synthetic Covered Calls

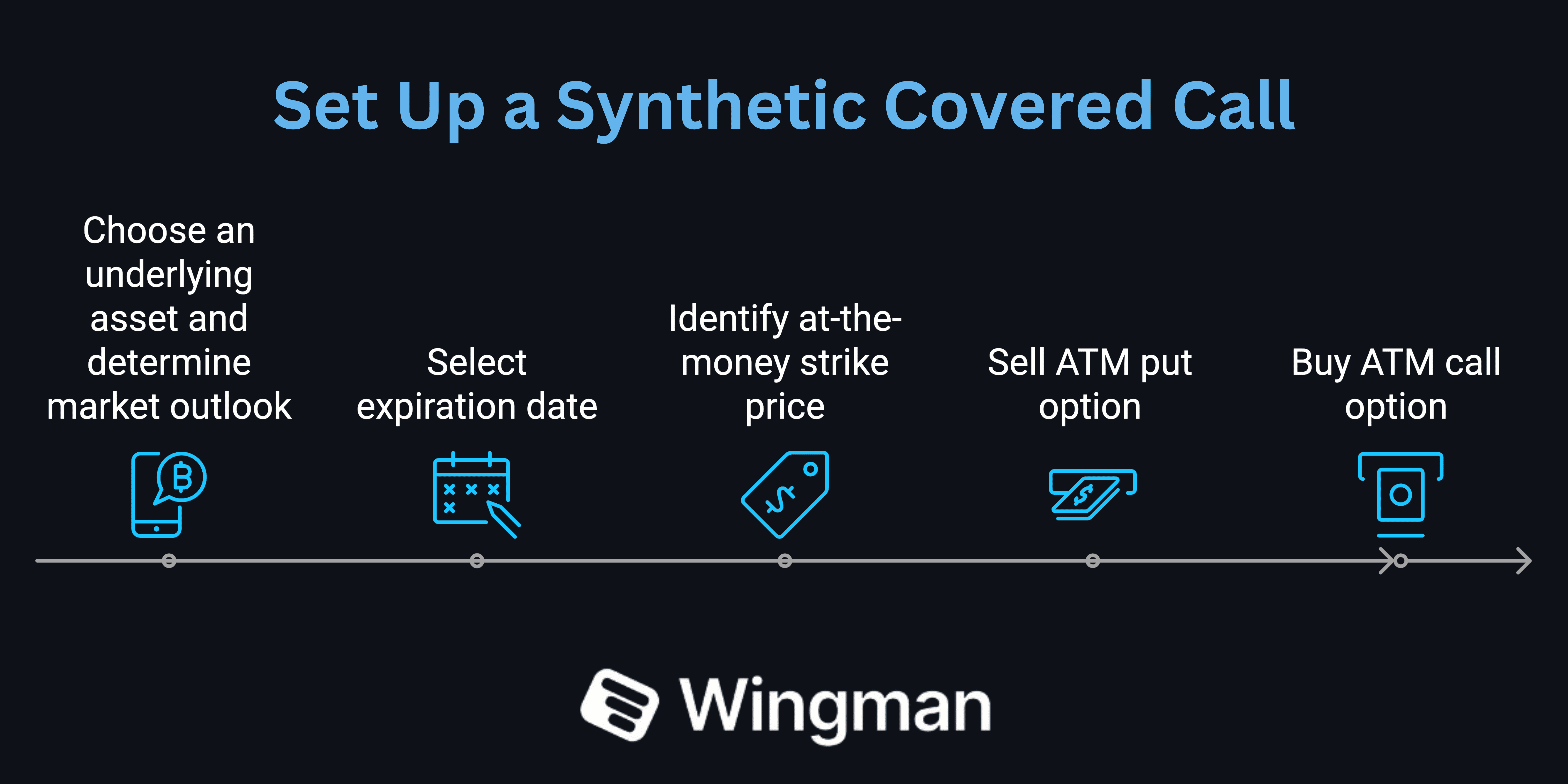

Setting up a synthetic covered call involves the following steps:

Choose an underlying asset and determine your market outlook.

Select an appropriate expiration date based on your trading goals and time horizon.

Identify the at-the-money strike price for both the put and call options.

Sell one ATM put option contract.

Buy one ATM call option contract with the same strike price and expiration as the put.

When selecting strike prices and expiration dates, consider factors such as implied volatility, time decay, and your manage your risk exposure with an options tracker.

Longer-dated options may offer more premium but come with increased time value risk.

To calculate potential profits and losses, consider the following:

Maximum Profit = (Short Put Premium + Long Call Premium) + (Stock Price at Expiration - Strike Price) Maximum Loss = Unlimited (theoretically, if the stock price falls to zero) Breakeven Point = Strike Price - Net Premium Received

The strategy profits if the stock price remains above the breakeven point at expiration.

If the stock price rises significantly, the long call provides upside potential.

If the stock price falls below the strike price, the position behaves like owning the stock at the strike price minus the net premium received.

Understanding these mechanics allows traders to assess the risk profile of synthetic covered calls and make informed decisions about when and how to implement this options strategy.

It's important to note that while synthetic covered calls can be a powerful tool, they also carry a high degree of risk and may not be suitable for all investors.

Advantages of Synthetic Covered Calls

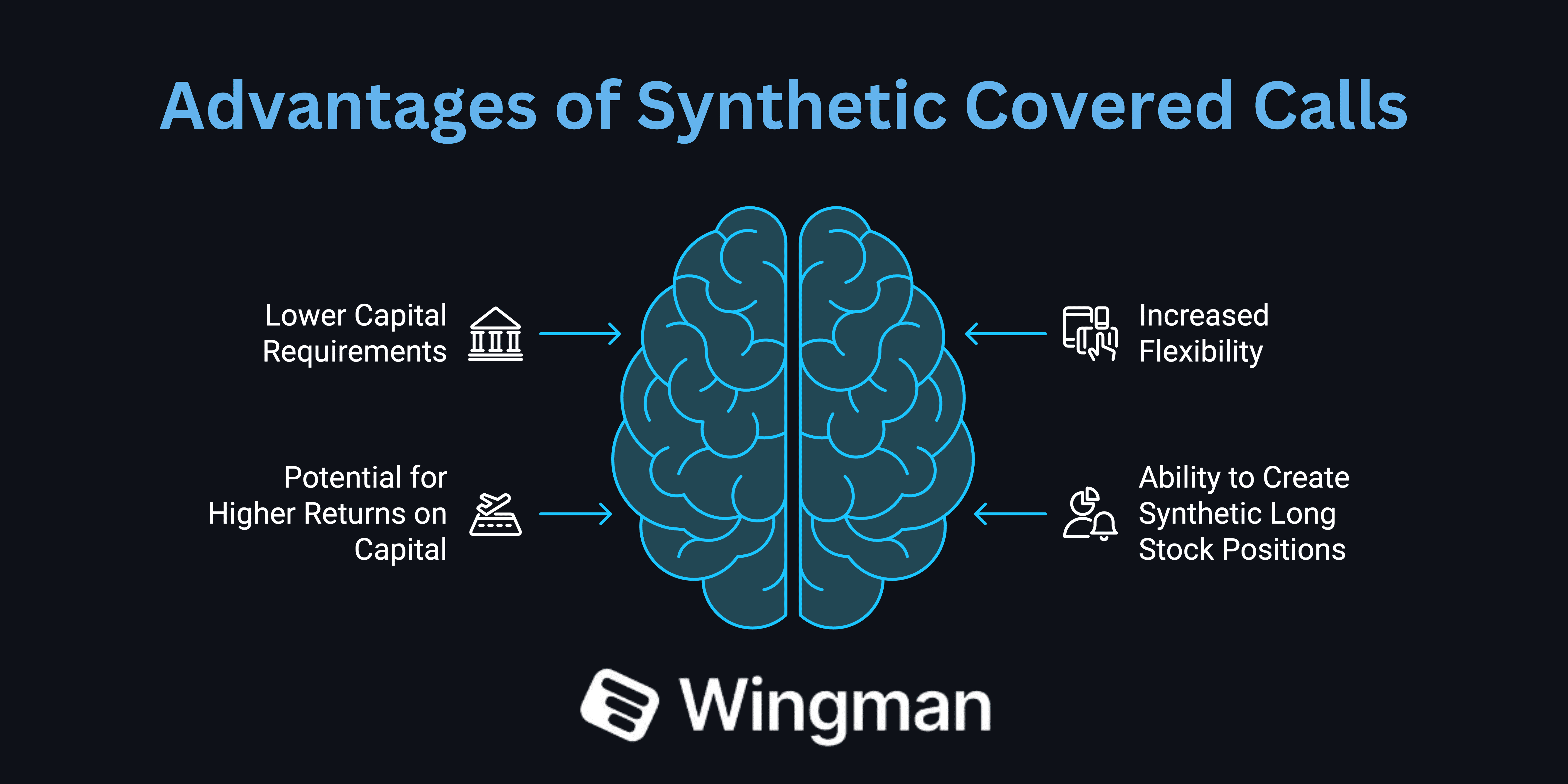

Synthetic covered calls offer several advantages over traditional covered calls:

Lower capital requirements: Unlike traditional covered calls, which require owning the underlying stock, synthetic covered calls can be implemented with less capital. This allows traders to potentially generate similar returns on a smaller initial investment, improving capital efficiency.

Increased flexibility: Synthetic positions can be easily adjusted or closed by trading the individual options components. This flexibility allows traders to respond quickly to changing market conditions or adjust their strategy as needed.

Potential for higher returns on capital: Due to the lower capital requirements, synthetic covered calls may offer higher percentage returns on invested capital compared to traditional covered calls. This can be particularly attractive for traders looking to maximize their capital efficiency in options trading.

Ability to create synthetic long stock positions: By combining a short put and a long call, traders can simulate a long stock position without actually owning the shares. This can be useful for traders who want exposure to a stock but prefer not to tie up capital in share ownership or face potential issues with stock borrowing for short sales.

These advantages make synthetic covered calls an attractive option for traders seeking to optimize their options strategies and potentially enhance their returns.

However, it's important to weigh these benefits against the risks and complexities associated with the strategy, including the unlimited risk potential and the need for a margin account.

Risks and Disadvantages

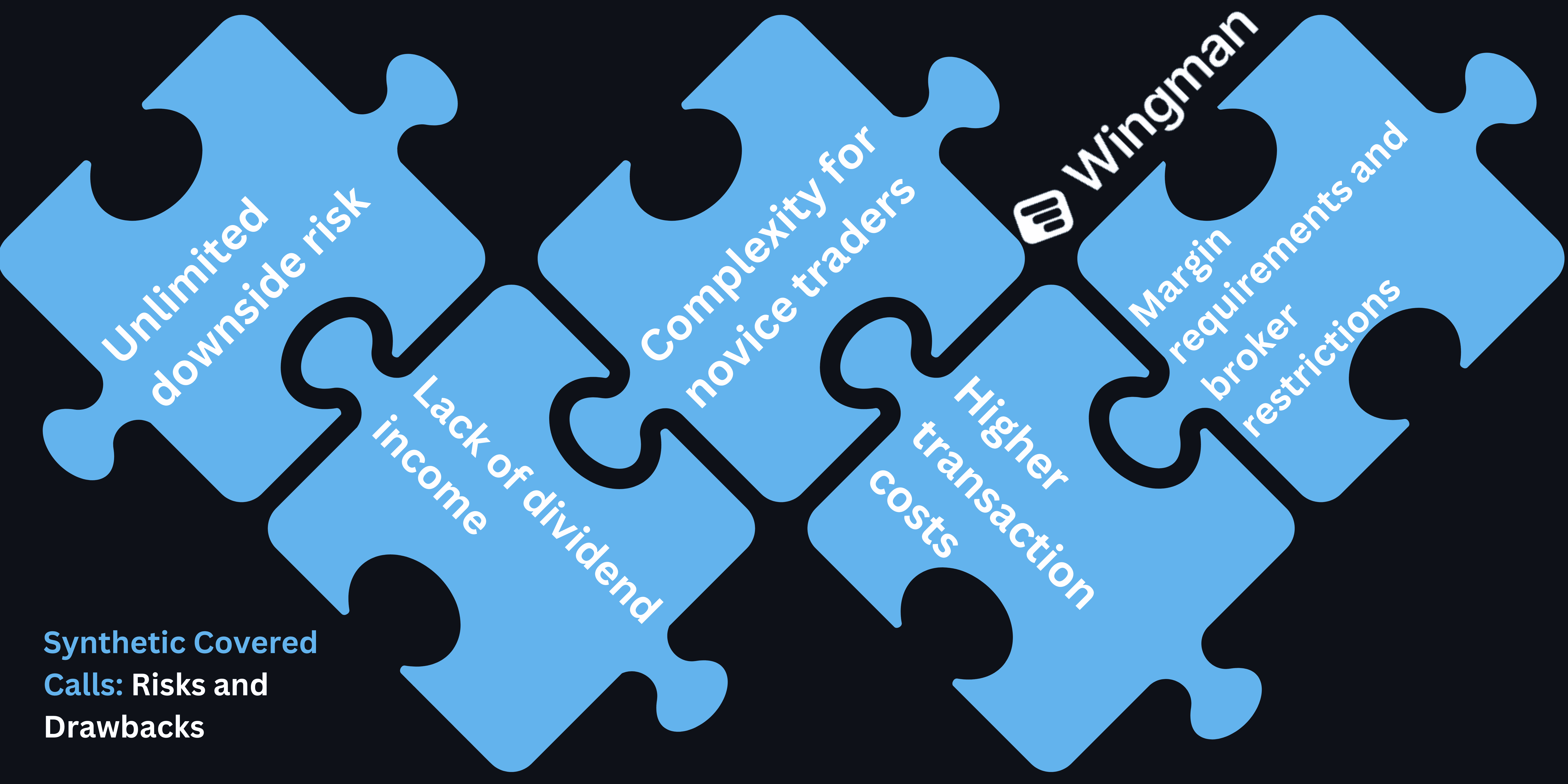

While synthetic covered calls offer advantages, they also come with risks and drawbacks:

Unlimited downside risk: Unlike traditional covered calls, where the maximum loss is limited to the stock's purchase price minus the premium received, synthetic covered calls have theoretically unlimited downside risk if the stock price falls to zero. This high degree of risk is a crucial factor for traders to consider.

Margin requirements and broker restrictions: Synthetic covered calls typically require a margin account and may be subject to higher margin requirements than traditional covered calls. Some brokers may also restrict access to this strategy for certain account types or experience levels. Traders should be aware of their broker's specific policies and margin requirements.

Lack of dividend income: Unlike owning the underlying stock in a traditional covered call, synthetic covered calls do not provide dividend income. This can be a disadvantage for traders seeking regular cash flow from their positions.

Complexity for novice traders: Synthetic strategies can be more complex to understand and manage compared to simpler options strategies. This complexity may make it challenging for novice traders to implement and adjust these positions effectively. It's important for traders to thoroughly educate themselves before engaging in synthetic covered calls.

Higher transaction costs: Since synthetic covered calls involve multiple options contracts, they may incur higher commission costs compared to traditional covered calls or simple stock positions. These additional costs can impact overall profitability and should be factored into the investment decision.

Traders considering synthetic covered calls should carefully evaluate these risks and disadvantages in the context of their trading goals, risk tolerance, and experience level.

Proper risk management and a thorough understanding of the strategy are essential for successful implementation in options trading.

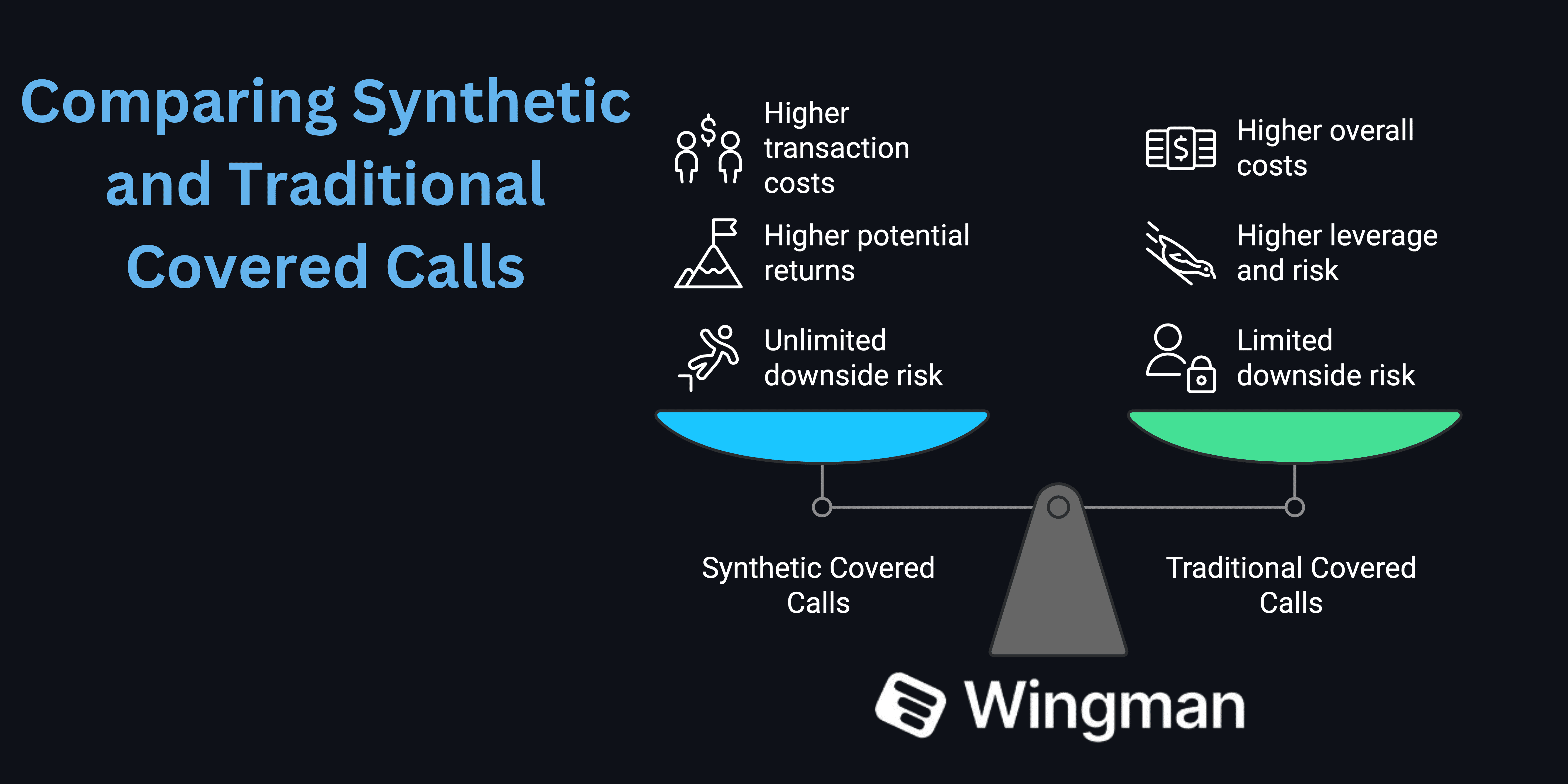

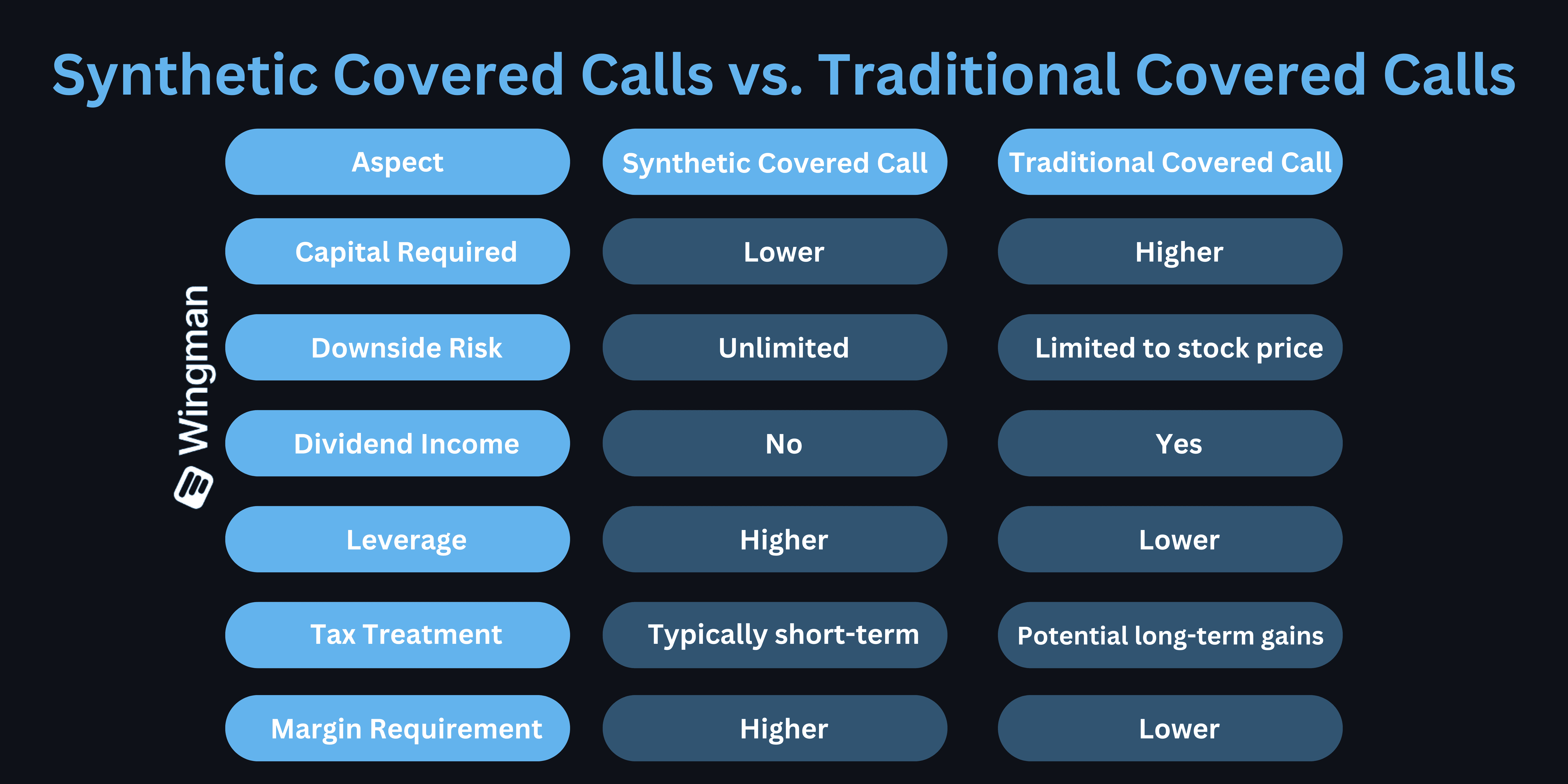

Comparing Synthetic Covered Calls to Traditional Covered Calls

Payoff diagrams and risk profiles: Synthetic covered calls and traditional covered calls have similar payoff diagrams, with limited upside potential and downside risk.

However, synthetic covered calls have theoretically unlimited downside risk, while traditional covered calls are limited to the stock's purchase price minus the premium received.

Capital efficiency: Synthetic covered calls typically require less capital than traditional covered calls, as they don't involve purchasing the underlying stock.

This can lead to higher potential returns on invested capital but also increases leverage and risk.

Commissions and transaction costs: Synthetic covered calls may incur higher transaction costs due to the need to trade multiple options contracts.

Traditional covered calls involve fewer transactions but may have higher overall costs due to the stock purchase.

Tax implications: The tax treatment of synthetic and traditional covered calls can differ.

Traditional covered calls may qualify for more favorable long-term capital gains treatment if the stock is held for over a year.

Synthetic covered calls are typically treated as short-term gains or losses, which may result in higher tax rates.

Traders should consult with a tax professional for specific advice on their financial situation.

Understanding these differences helps traders choose the most appropriate options strategy for their goals and risk tolerance.

It's important to note that while synthetic covered calls can offer advantages in terms of capital efficiency, they also come with increased risk and complexity that may not be suitable for all investors.

Advanced Concepts and Variations

Synthetic covered call vs. cash-secured put: A synthetic covered call behaves similarly to a cash-secured put, as both strategies involve potential stock ownership at a specific price.

However, the synthetic covered call includes a long call component, providing upside potential if the stock price rises significantly.

Split-strike synthetic covered call: This variation uses different strike prices for the short put and long call.

For example, selling an out-of-the-money put and buying an out-of-the-money call.

This approach can reduce the cost of the strategy but may also limit potential profits.

Combining with other options strategies: Synthetic covered calls can be combined with other options strategies to create more complex positions.

For example:

Adding a short call to create an iron condor-like position

Using multiple expirations to create a calendar spread component

Incorporating additional puts or calls to adjust the risk-reward profile

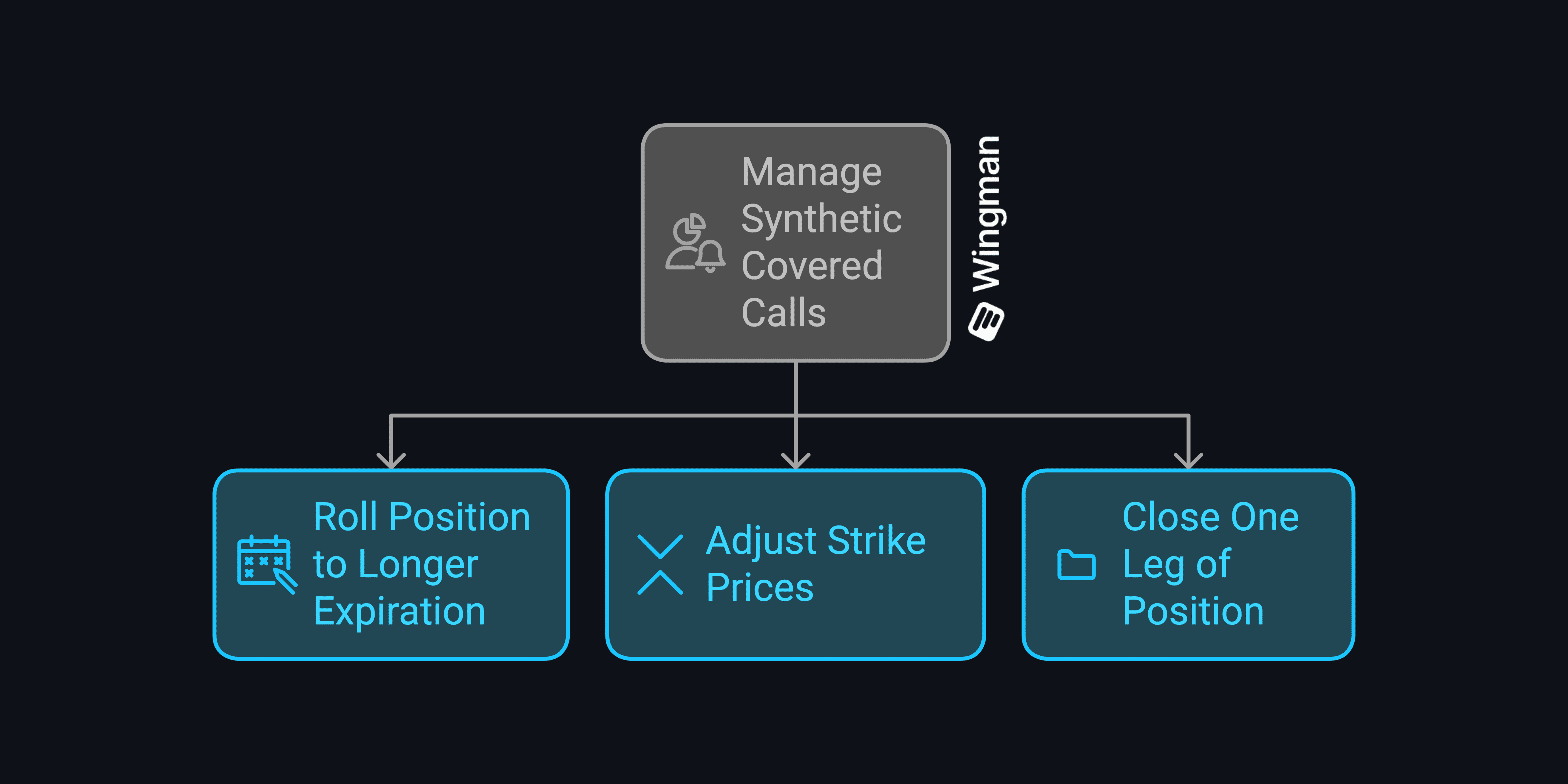

Rolling and adjusting synthetic covered call positions:

Traders can manage synthetic covered calls by:

Rolling the position to a longer expiration date

Adjusting strike prices to respond to market movements

Closing one leg of the position to modify exposure

These advanced concepts and variations allow traders to fine-tune their synthetic covered call strategies to better align with their market outlook and risk preferences.

However, they also increase complexity and require careful analysis and management in options trading.

It's important to note that these advanced techniques may not be suitable for all investors and carry additional risks.

Traders should thoroughly understand the implications of these strategies and consult with a financial advisor or registered broker-dealer before implementing them in their trading.

Market Scenarios and Strategy Application

Bullish market outlook: In a bullish market, synthetic covered calls can benefit from stock price appreciation through the long call component.

Traders might consider using out-of-the-money options to increase potential profits if the stock price rises significantly.

This approach can be particularly effective when a trader has a strong bullish view on the underlying asset.

Neutral market outlook: For a neutral outlook, at-the-money options may be preferred.

The strategy can profit from time decay and small price movements in either direction.

Traders might focus on stocks with high implied volatility to collect larger option premiums.

This approach can be effective in range-bound markets or when a trader expects minimal price movement in the underlying asset.

Bearish market outlook: While not ideal for bearish markets, synthetic covered calls can be adjusted by using in-the-money options or combining with protective puts to create a collar-like position.

Alternatively, traders might consider switching to a different options strategy altogether, such as a synthetic long put or a bear spread.

High volatility vs. low volatility environments: In high volatility environments, synthetic covered calls can benefit from higher option premiums. Traders might focus on shorter-term options to capitalize on rapid time decay and potentially higher returns.

In low volatility environments, longer-term options may be preferred to collect meaningful premiums.

Traders might also consider using out-of-the-money options to increase potential returns if volatility increases.

Applying synthetic covered calls effectively requires assessing market conditions, individual stock characteristics, and overall portfolio strategy.

Traders should adapt their approach based on changing market scenarios and their evolving market outlook.

It's crucial to remember that past performance does not guarantee future results, and unique conditions or events such as quad witching can alter market trading conditions rapidly, affecting the performance of any options strategy.

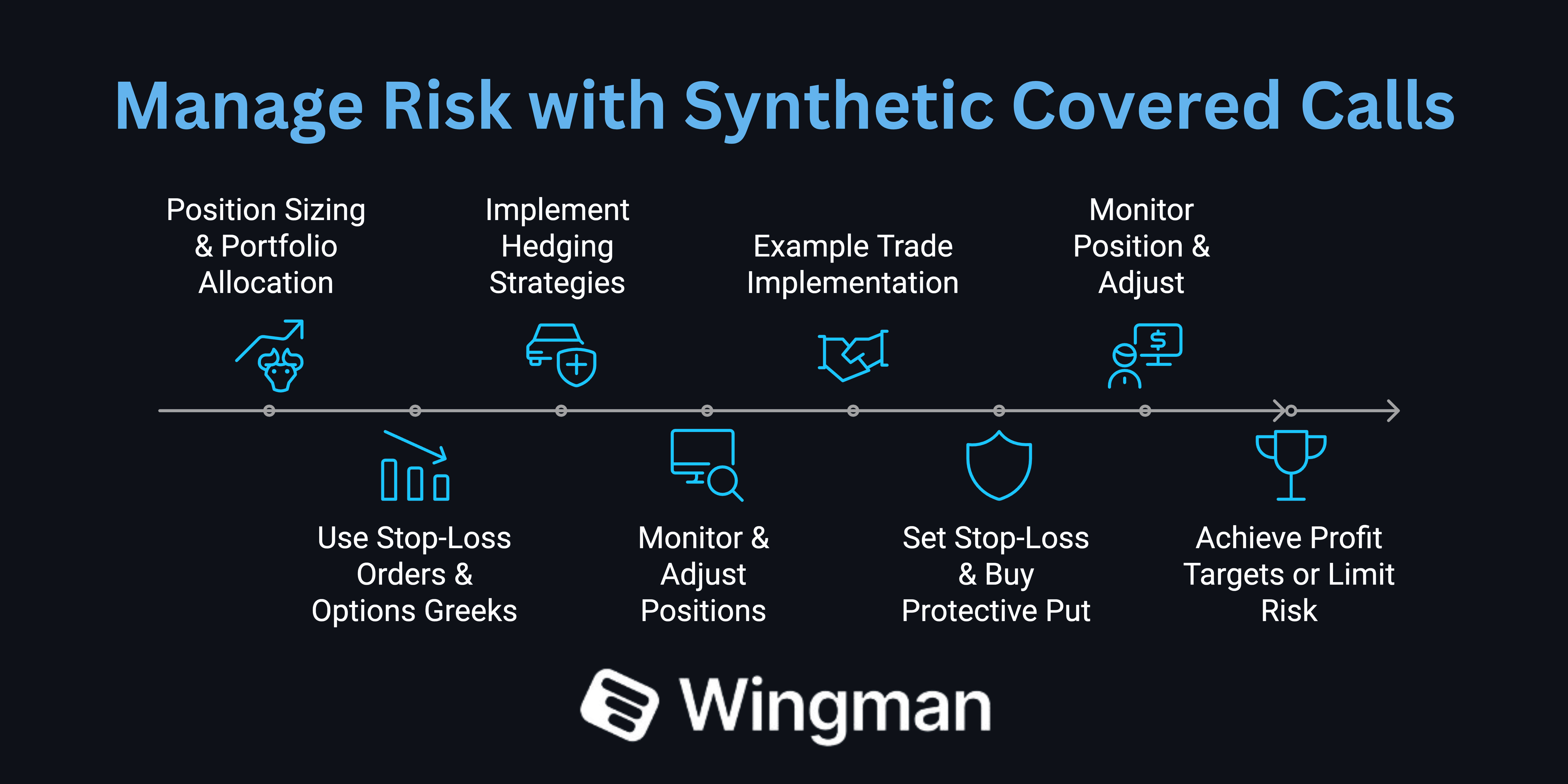

Risk Management Techniques

Position sizing and portfolio allocation: Limit the size of synthetic covered call positions relative to overall portfolio value.

Consider correlations between multiple positions to avoid overexposure to specific sectors or market factors.

Proper position sizing is crucial for managing the high degree of risk associated with synthetic strategies.

Using stop-loss orders and options Greeks: Implement stop-loss orders on the overall position or individual legs to limit potential losses. Monitor options Greeks, particularly delta and theta, to assess and manage risk exposure. Understanding and utilizing options Greeks can help traders make more informed decisions about their positions.

Hedging strategies:

Buy protective puts to limit downside risk

Sell call spreads instead of naked calls to cap potential losses

Use index options or ETF options to hedge sector or market risk

Monitoring and adjusting positions:

Regularly review synthetic covered call positions and adjust as needed:

Roll options to later expirations if more time is needed

Adjust strike prices in response to significant price movements

Close positions that have achieved profit targets or reached risk limits

Risk management example: A trader implements a synthetic covered call on XYZ stock trading at $50:

Sell 1 XYZ $50 put for $2

Buy 1 XYZ $50 call for $3

Net debit: $1

To manage risk, the trader:

Sets a stop-loss at $45 (10% below the strike price)

Buys a protective $45 put for $0.50 to limit downside risk

Monitors the position daily, adjusting if XYZ moves significantly

Effective risk management is crucial for successful implementation of synthetic covered call strategies, helping traders protect their capital and optimize their returns in options trading.

It's important to note that while these techniques can help mitigate risk, they cannot eliminate it entirely, and traders should be prepared for potential losses.

Practical Examples and Case Studies

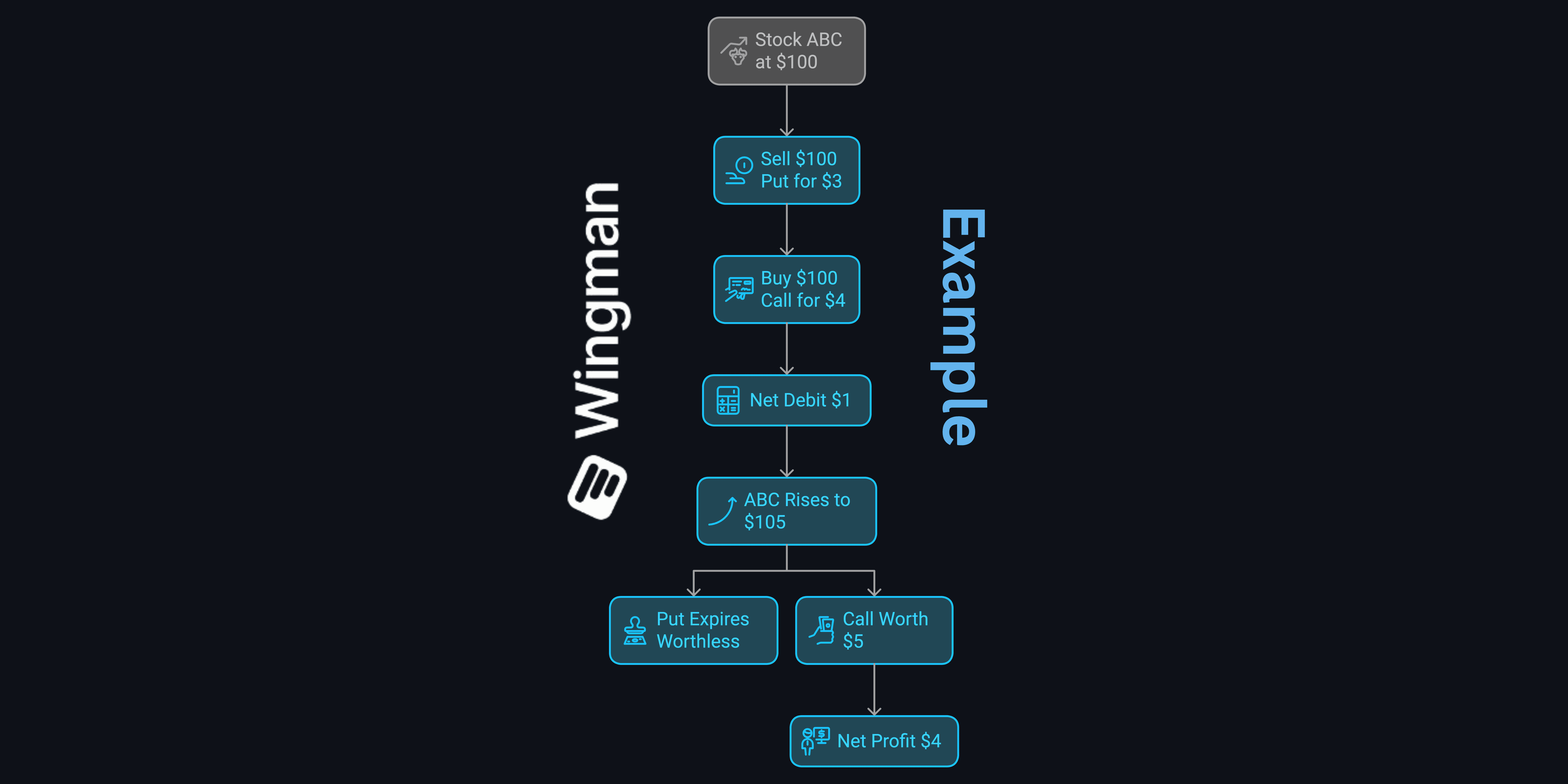

Successful synthetic covered call trade: Stock ABC trading at $100

Sell 1 ABC $100 put for $3

Buy 1 ABC $100 call for $4

Net debit: $1

ABC rises to $105 at expiration:

Put expires worthless

Call is worth $5

Net profit: $4 ($5 - $1 initial debit)

Lesson: The strategy profited from the stock's upward movement while limiting capital outlay. This example demonstrates how synthetic covered calls can benefit from bullish market conditions.

Unsuccessful trade: Stock XYZ trading at $50

Sell 1 XYZ $50 put for $2

Buy 1 XYZ $50 call for $3

Net debit: $1

XYZ drops to $45 at expiration:

Put is assigned, requiring stock purchase at $50

Call expires worthless

Net loss: $6 ($5 stock loss + $1 initial debit)

Lesson: Downside risk can be substantial if the stock price falls significantly. This case highlights the importance of risk management in synthetic covered call strategies.

Real-world application: High implied volatility scenario: Stock DEF trading at $75 with high IV due to earnings

Sell 1 DEF $75 put for $5

Buy 1 DEF $75 call for $6

Net debit: $1

DEF remains at $75 after earnings:

Both options expire worthless

Net profit: $4 ($5 put premium - $1 initial debit)

Lesson: High implied volatility can lead to profitable outcomes even if the stock price doesn't move. This example illustrates how synthetic covered calls can be used to capitalize on volatility.

These examples illustrate how synthetic covered calls perform in various market conditions, highlighting both the potential benefits and risks of the strategy in options trading.

It's important to note that these are simplified examples, and real-world trading may involve additional complexities and risks.

Traders should always consider their own financial situation and risk tolerance before implementing any options strategy.

Tools and Resources for Trading Synthetic Covered Calls

Options pricing calculators and analysis software:

Option Profit Calculator: Online tool for visualizing options strategies

OptionNet Explorer: Comprehensive options analysis software

ThinkorSwim: TD Ameritrade's platform with advanced options tools

These tools help traders model synthetic covered call positions, analyze risk-reward profiles, and assess the impact of changes in underlying price, volatility, and time to expiration.

Broker platforms with synthetic strategy capabilities:

Interactive Brokers: Offers advanced options trading and strategy building

E*TRADE: Provides options strategy tools and education

Fidelity: Features options strategy analyzers and trade builders

These platforms allow traders to execute synthetic covered calls and other complex options strategies efficiently.

Many of these brokers also offer paper trading accounts for practice without risking real capital.