Education

How to Trade Options - From Beginner to Pro

by

Patricia

Oct 7, 2024

2

min read

Tired of Tracking Options Trades in a spreadsheet?

Try WingmanTracker Free for 30 Days

100% Money-Back Guarantee

Options trading has become a popular way for investors to potentially generate income and manage risk in their portfolios.

This guide will take you through the steps to become a successful options trader, from understanding the basics to mastering advanced strategies.

Options trading involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a set time frame.

This form of trading can offer flexibility and potential for profit, but it also comes with risks.

Many investors are drawn to options trading for its potential to generate income, hedge against market volatility, and provide leverage.

However, becoming a successful options trader requires knowledge, skill, and discipline.

This article will cover everything you need to know to start your journey as an options trader, including basic concepts, essential skills, trading strategies, risk management, and tips for transitioning to full-time trading.

Understanding Options Trading Basics

Options are financial derivatives that give buyers the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a predetermined price (strike price) before a specific date (expiration date).

Calls and puts are the two main types of options.

A call option gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell it.

The price paid for an option is called the premium.

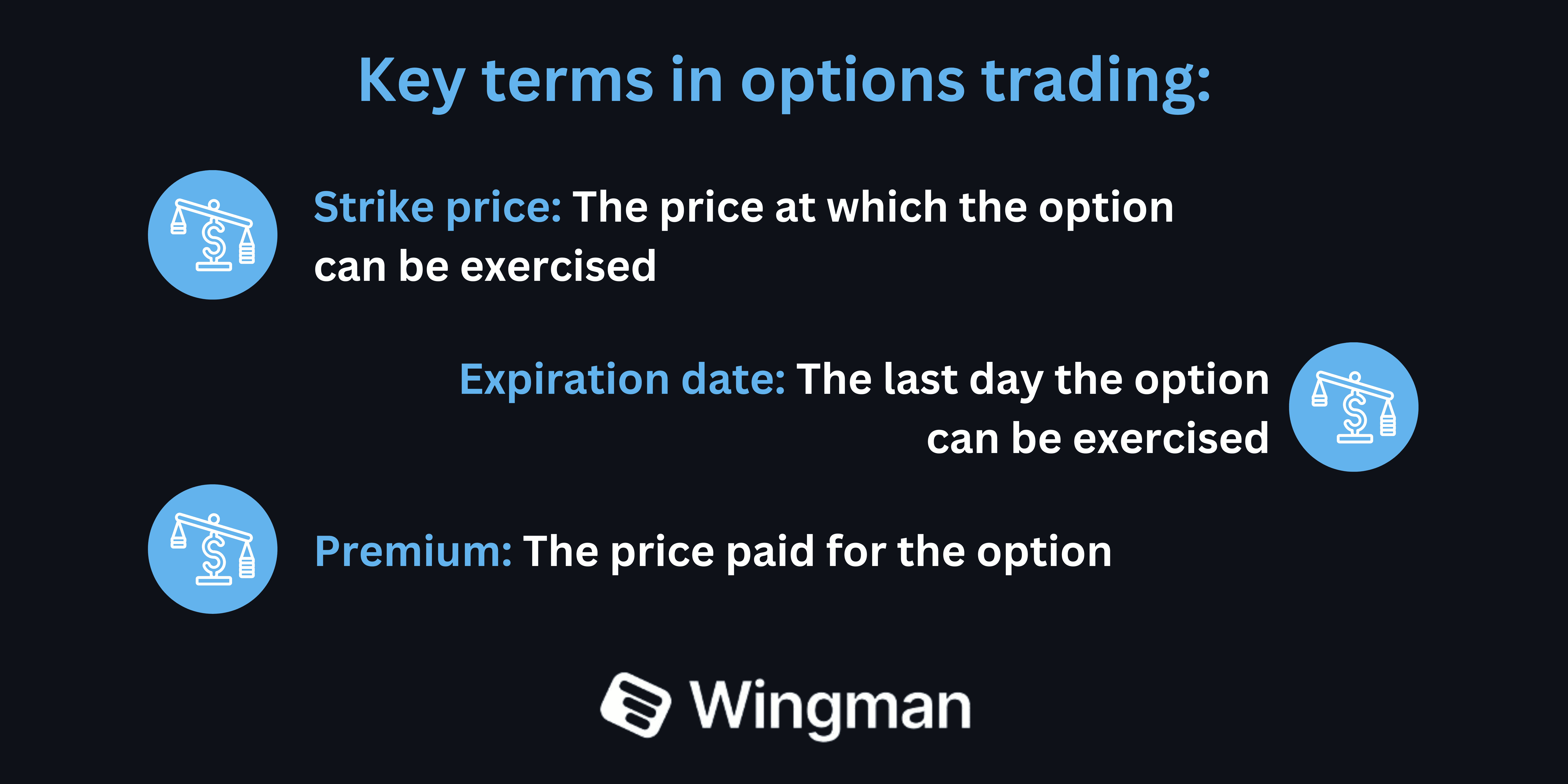

Key terms in options trading include:

Strike price: The price at which the option can be exercised

Expiration date: The last day the option can be exercised

Premium: The price paid for the option

The Greeks are metrics used to measure the sensitivity of an option's price to various factors:

Delta: Measures the rate of change in the option's price with respect to the change in the underlying asset's price

Gamma: Measures the rate of change in delta

Theta: Measures the rate at which an option's value declines over time

Vega: Measures the option's sensitivity to changes in volatility

American options can be exercised at any time before expiration, while European options can only be exercised on the expiration date.

Understanding these basics is crucial for anyone looking to trade options successfully.

Getting Started as an Options Trader

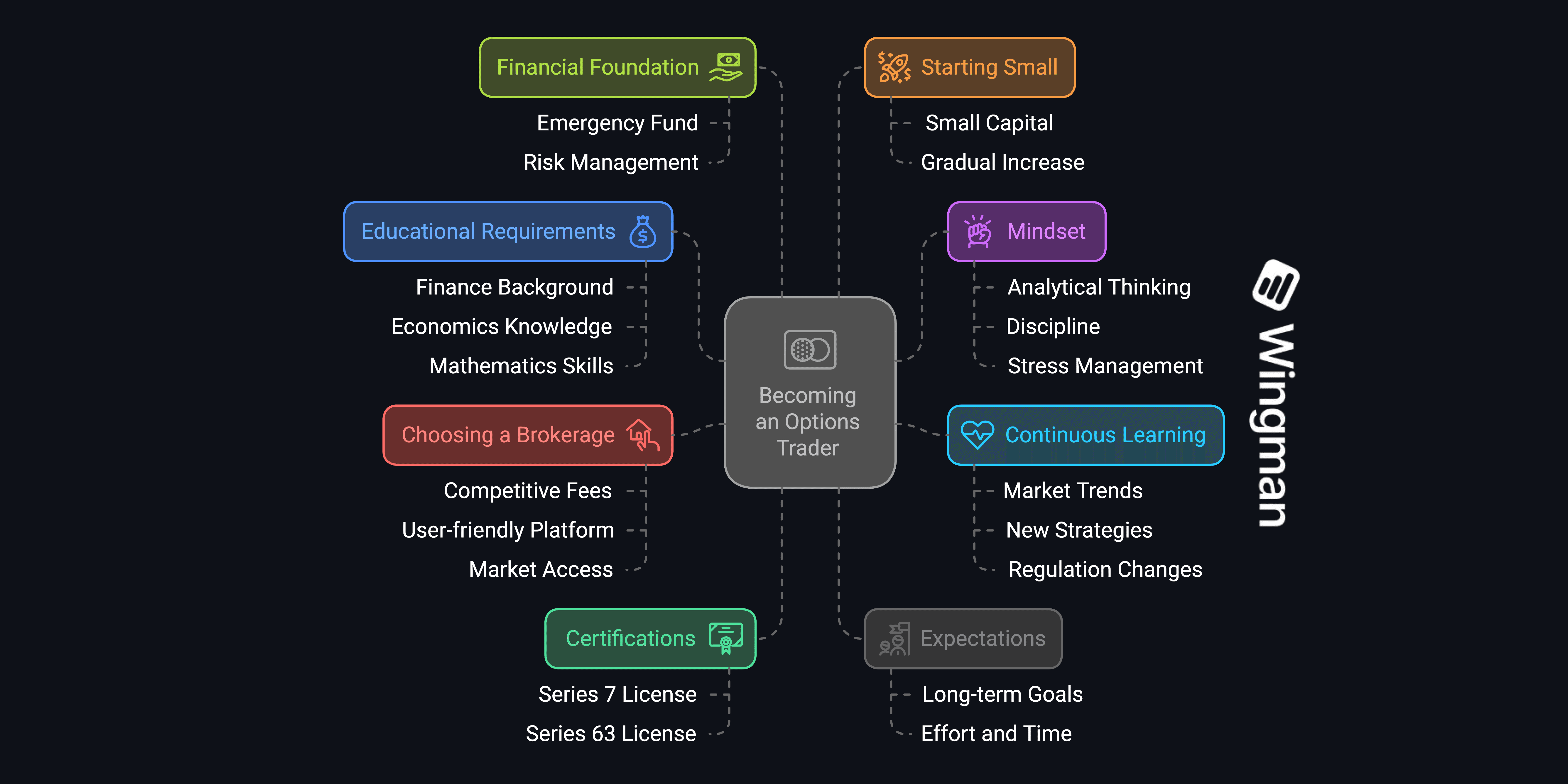

To begin your career as an options trader, consider the following steps:

Educational requirements: While a formal degree isn't always necessary, a strong background in finance, economics, or mathematics can be beneficial. Many successful traders have degrees in these fields or related areas.

Certifications: Consider obtaining certifications such as the Series 7 and Series 63 licenses, which are required for many professional trading positions.

Develop the right mindset: Successful options traders are typically analytical, disciplined, and able to manage stress well. They're also comfortable with taking calculated risks and can remain calm under pressure.

Set realistic expectations: Understand that options trading is not a get-rich-quick scheme. It requires time, effort, and continuous learning to become profitable consistently.

Create a solid financial foundation: Before you start trading options, ensure you have a stable financial situation. This includes having an emergency fund and not trading with money you can't afford to lose.

Start small: Begin with a small amount of capital and gradually increase your investment as you gain experience and confidence in your trading abilities.

Continuous learning: Stay updated with market trends, new strategies, and changes in regulations that may affect options trading. Consider taking online courses or attending seminars to enhance your knowledge.

Choose a brokerage firm: Select a reputable broker that offers competitive fees, a user-friendly platform, and access to the financial markets you're interested in trading.

Essential Skills for Successful Options Trading

To thrive as an options trader, you need to develop and hone several key skills:

Technical analysis: This involves studying price charts and using various indicators to predict future price movements. Learn to identify trends, support and resistance levels, and chart patterns.

Fundamental analysis: Understand how economic factors, company financials, and industry trends can affect the underlying assets and, consequently, options prices.

Market research: Stay informed about market news, economic indicators, and company-specific events that can impact your trades.

Risk management: Learn to assess and manage the risks associated with each trade. This includes setting stop-loss orders, diversifying your portfolio, and not overexposing yourself to any single position.

Emotional control: Develop the ability to make rational decisions based on analysis rather than emotions. Fear and greed can lead to poor trading decisions.

Discipline: Stick to your trading plan and avoid impulsive trades. This includes knowing when to exit a trade, whether it's profitable or not.

Adaptability: Markets are constantly changing, so you need to be able to adjust your strategies accordingly.

Mathematical skills: Options trading often involves complex calculations. A strong grasp of mathematics, particularly statistics and probability, can be very helpful.

Time management: Learn to balance your trading activities with research, analysis, and continuous learning.

Record-keeping: Maintain detailed records of your trades to analyze your performance and identify areas for improvement.

Successful options traders often combine these skills with a deep understanding of market conditions and the ability to interpret market data effectively.

Building Your Options Trading Strategy

Developing a solid trading strategy is crucial for success in options trading.

Here are some common strategies to consider:

Covered call: This involves owning the underlying stock and selling call options against it. It's a relatively conservative strategy that can generate income.

Protective put: Buy put options to protect a long stock position against potential downside.

Bull call spread: Buy a call option while simultaneously selling another call option with a higher strike price. This strategy is used when you expect a moderate rise in the underlying asset's price.

Bear put spread: Similar to a bull call spread, but using put options when you expect a moderate decline in the underlying asset's price.

Iron condor: This strategy involves selling both a call and a put spread. It's used when you expect the underlying asset to remain within a specific price range.

Straddle: Buy both a call and a put with the same strike price and expiration date. This strategy is used when you expect significant price movement but are unsure of the direction.

Option wheel: a multi-step strategy that involves selling cash-secured puts until assignment, then selling covered calls on the acquired shares, and repeating this cycle

As you gain experience, you can explore more advanced options strategies like butterflies, synthetic covered calls, calendars, and ratio spreads.

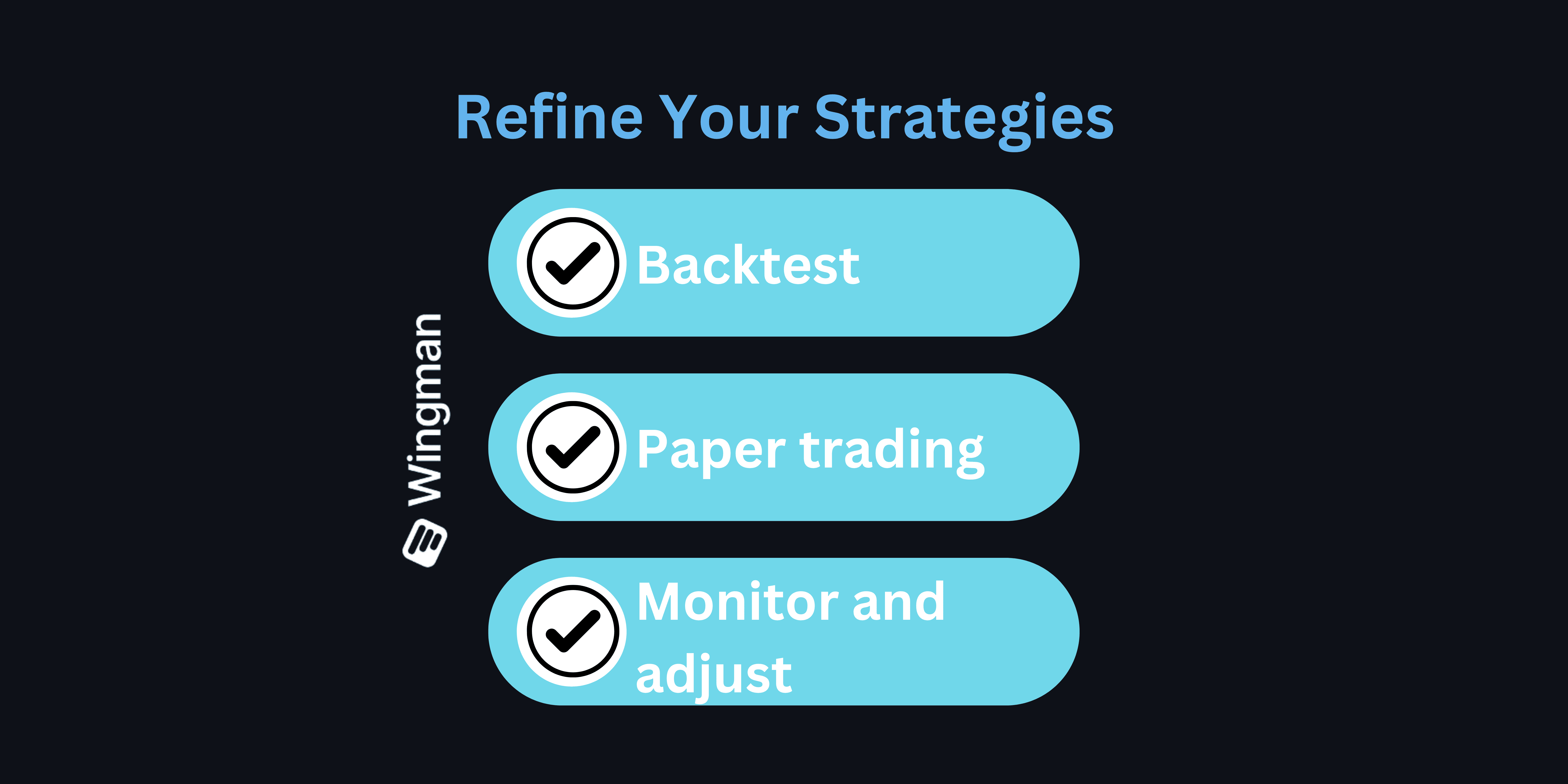

To refine your strategies:

Backtest: Use historical data to see how your strategy would have performed in the past.

Paper trading: Practice your strategies with virtual money before risking real capital. This allows you to gain experience without the risk of losing real money.

Monitor and adjust: Regularly review your strategies and make adjustments based on market conditions and your performance.

Remember, no strategy works all the time.

Be prepared to adapt your approach as market conditions change.

Successful options traders often have multiple strategies they can employ depending on the current market trends and volatility.

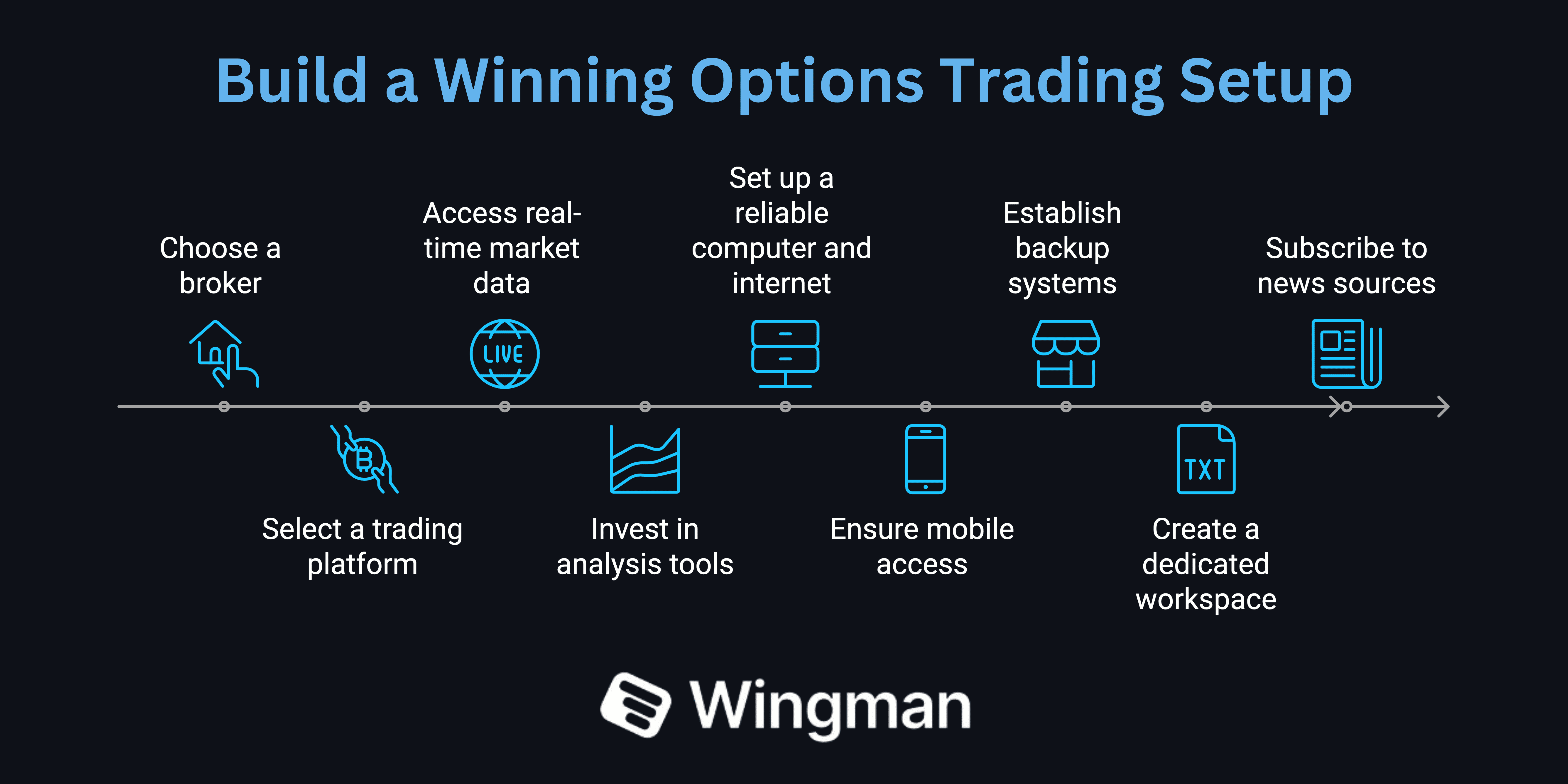

Setting Up Your Trading Infrastructure

To trade options effectively, you need the right tools and environment.

Here's what you should consider:

Choose a broker: Look for a broker that offers competitive fees, a user-friendly platform, good customer support, and educational resources. Some popular options include TD Ameritrade, E*TRADE, and Interactive Brokers.

Trading platform: Your broker will provide a trading platform, but you may want to consider additional software for advanced charting and analysis. Examples include ThinkorSwim, TradeStation, and MetaTrader.

Market data: Access to real-time market data is crucial. Many brokers provide this, but you might want to consider additional data feeds for more comprehensive information.

Analysis tools: Invest in software that can help with technical analysis, options pricing models, and risk assessment. Some traders use Excel for custom analysis, while others prefer specialized options analysis software.

Computer setup: A reliable computer with a fast internet connection is essential. Consider using multiple monitors to view charts, news, and your trading platform simultaneously.

Mobile access: Choose platforms that offer mobile apps so you can monitor your positions and execute trades when you're away from your desk.

Backup systems: Have a backup internet connection and power source to avoid disruptions during trading hours.

Workspace: Create a quiet, comfortable space dedicated to trading. This helps minimize distractions and maintain focus.

News sources: Subscribe to financial news services and set up alerts for important announcements that could affect your trades.

Trade journal: Use a spreadsheet or specialized software to track your trades, including entry and exit points, reasons for the trade, and outcomes.

Having a well-organized trading infrastructure can significantly improve your efficiency and decision-making process as an options trader.

Developing a Trading Plan and Routine

A well-structured trading plan and routine are essential for consistent success in options trading. Here's how to develop them:

Creating a comprehensive trading plan:

Define your goals: Set clear, measurable objectives for your trading activities.

Determine your risk tolerance: Decide how much capital you're willing to risk on each trade and overall.

Choose your strategies: Outline the specific strategies you'll use and under what market conditions.

Set entry and exit rules: Establish clear criteria for when to enter and exit trades.

Plan for different scenarios: Consider how you'll respond to various market conditions.

Establishing a daily trading routine:

Pre-market preparation: Review overnight news, check your positions, and plan your trades for the day.

Market open: Monitor the market opening and execute any planned trades.

Mid-day review: Assess your open positions and make any necessary adjustments.

End-of-day analysis: Review your trades, update your trade journal, and plan for the next day.

Continuous learning: Allocate time for studying market trends and improving your skills.

Setting and tracking performance metrics:

Win rate: The percentage of your trades that are profitable.

Risk-reward ratio: The average amount you risk compared to your potential profit.

Sharpe ratio: A measure of risk-adjusted return.

Maximum drawdown: The largest peak-to-trough decline in your account.

Regularly review these metrics to identify areas for improvement in your trading strategy. Successful options traders often attribute their consistency to having a well-defined plan and sticking to a disciplined routine.

Remember, a good plan and routine provide structure but should also be flexible enough to adapt to changing market conditions.

Risk Management and Capital Preservation

Effective risk management is crucial for long-term success in options trading.

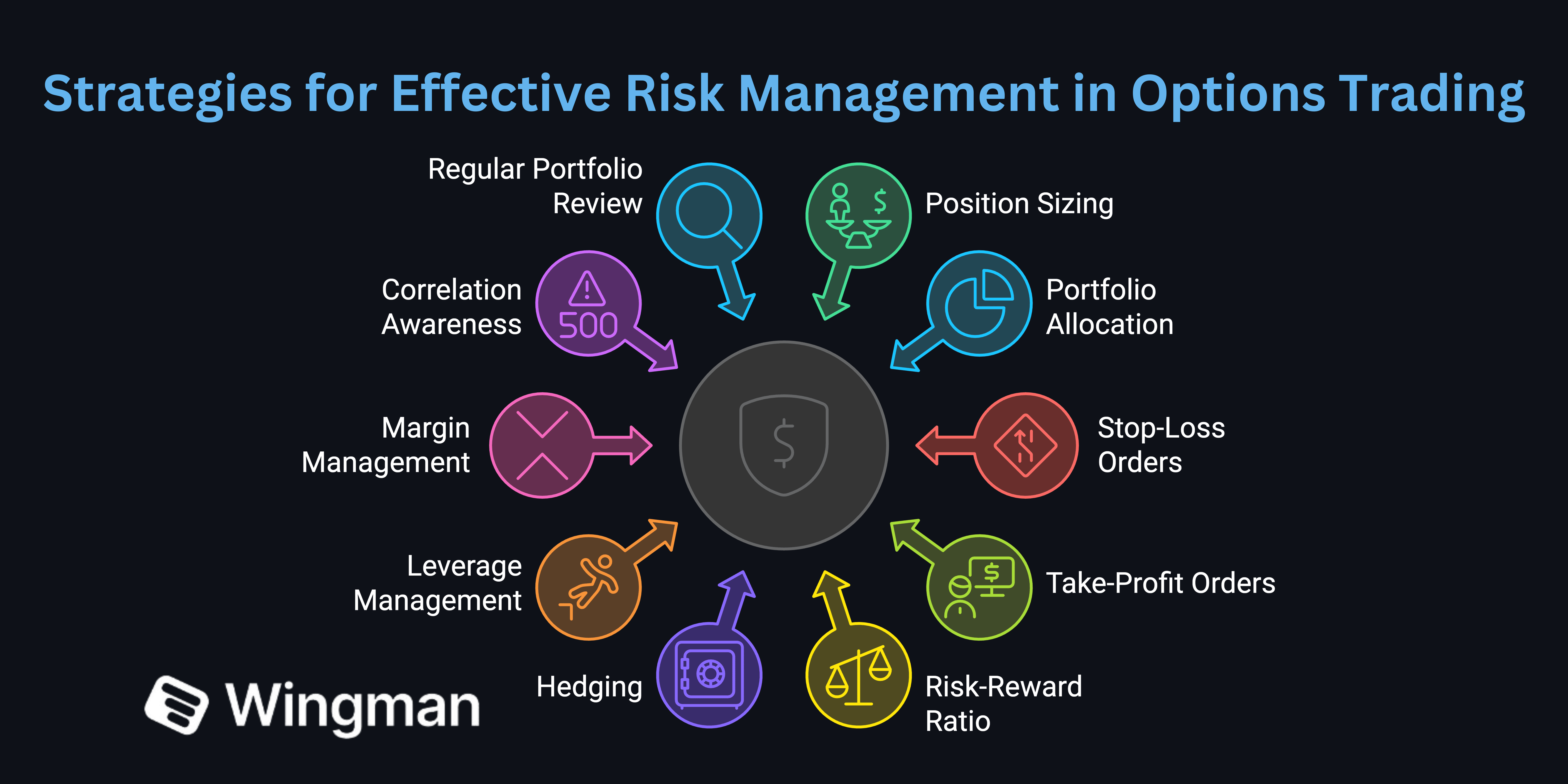

Here are key strategies to manage risk and preserve capital:

Position sizing: Limit the amount of capital you risk on any single trade. A common rule is to risk no more than 1-2% of your trading capital on a single position.

Portfolio allocation: Diversify your trades across different underlying assets and strategies to spread risk.

Stop-loss orders: Use stop-loss orders to automatically exit trades when they reach a predetermined loss level.

Take-profit orders: Set take-profit orders to lock in gains when a trade moves in your favor.

Risk-reward ratio: Aim for a favorable risk-reward ratio, typically at least 1:2 or 1:3, meaning your potential profit is at least twice your potential loss.

Hedging: Use options strategies like protective puts to hedge your positions against potential losses.

Leverage management: Be cautious with leverage. While it can amplify gains, it can also magnify losses.

Margin management: If trading on margin, maintain a healthy margin buffer to avoid forced liquidations.

Correlation awareness: Be mindful of correlations between your positions to avoid overexposure to a single market factor.

Regular portfolio review: Regularly assess your portfolio to ensure it aligns with your risk tolerance and market outlook.

Stress testing: Use scenario analysis to understand how your portfolio might perform under different market conditions.

Risk metrics: Monitor risk metrics like Value at Risk (VaR) and beta to quantify your portfolio's risk exposure.

Remember, the goal of risk management isn't to eliminate all risk, but to manage it in a way that allows for potential profits while protecting your trading capital.

Successful options traders often prioritize capital preservation over making quick profits.

Psychology of Options Trading

The psychological aspect of trading is often overlooked but is crucial for success.

Here's how to develop a winning trader's mindset:

Emotional control: Learn to manage emotions like fear and greed. These can lead to impulsive decisions and deviation from your trading plan.

Discipline: Stick to your trading plan and rules, even when it's tempting to break them.

Patience: Avoid overtrading. Wait for high-probability setups that align with your strategy.

Confidence: Build confidence through knowledge and experience, but avoid overconfidence.

Adaptability: Be willing to change your approach when market conditions shift.

Resilience: Learn to bounce back from losses, which are an inevitable part of trading.

Stress management: Develop techniques to manage stress, such as meditation or exercise.

Cognitive biases awareness: Recognize and mitigate common biases like confirmation bias and recency bias.

Continuous improvement: Maintain a growth mindset and always look for ways to improve your trading.

Work-life balance: Establish boundaries between trading and personal life to avoid burnout.

Dealing with losses:

Accept losses as part of trading: Understand that losses are inevitable and don't let them affect your emotional state.

Analyze losses objectively: Review losing trades to learn from them, not to assign blame.

Maintain perspective: Focus on long-term performance rather than individual trades.

Balancing work and trading:

Set realistic time commitments: Determine how much time you can dedicate to trading without neglecting other responsibilities.

Create a schedule: Allocate specific times for trading, analysis, and learning.

Use technology: Leverage tools like mobile apps to monitor positions when away from your desk.

Know your limits: Recognize when you need to step back from trading to avoid burnout.

Successful options traders often attribute their long-term success to maintaining a positive and disciplined trading psychology.

Advanced Options Trading Concepts

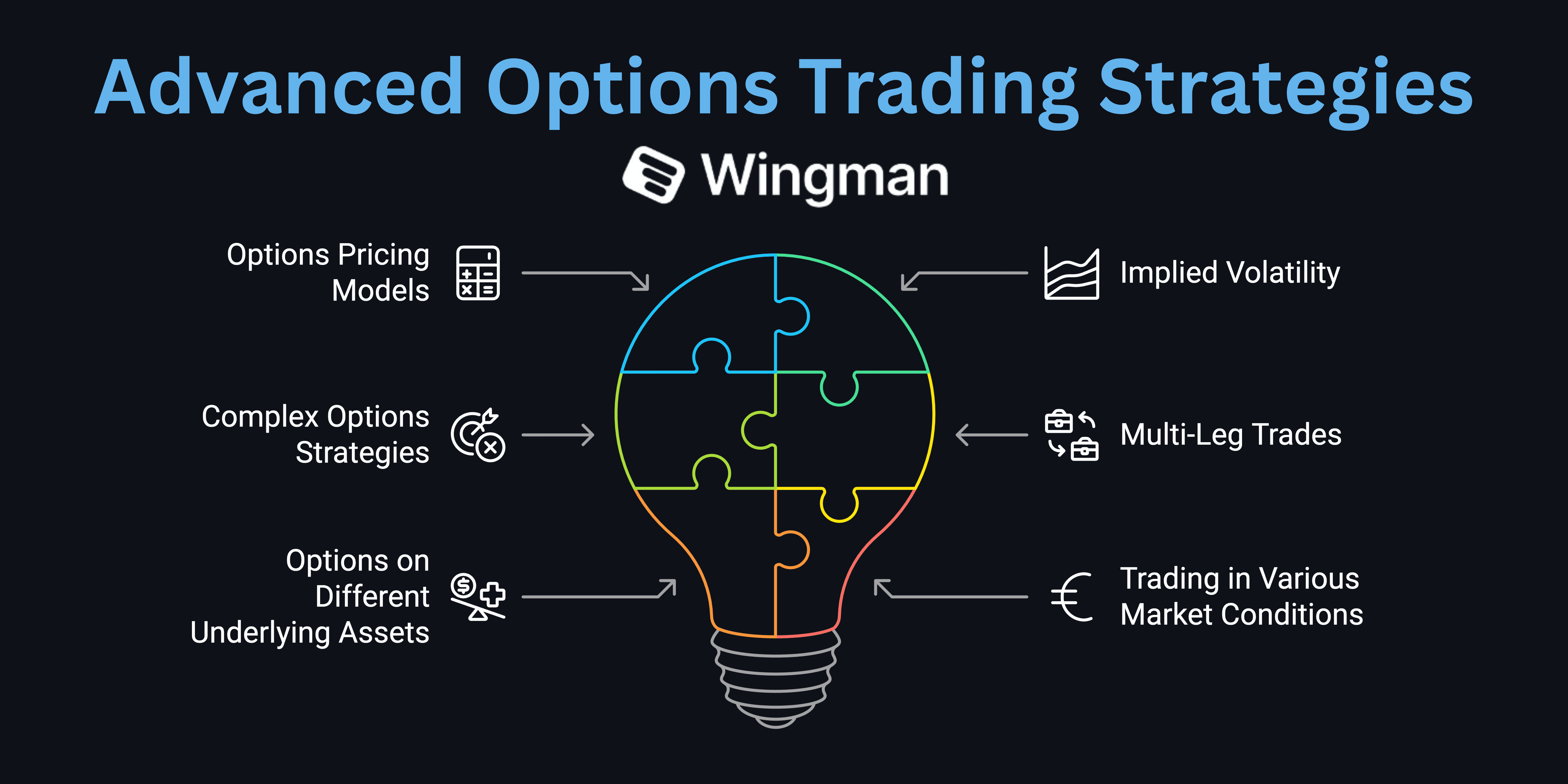

As you progress in your options trading journey, you'll encounter more complex concepts and strategies:

Options pricing models:

Black-Scholes model: The most widely used model for pricing European-style options.

Binomial model: Used for American-style options and considers multiple possible price paths.

Monte Carlo simulation: A method for pricing complex options by simulating multiple price scenarios.

Implied volatility (IV):

Definition: The market's forecast of likely movement in a security's price.

IV skew: The difference in IV between options with different strike prices.

IV term structure: How IV varies across different expiration dates.

Complex options strategies:

Iron butterfly: A combination of a bull put spread and a bear call spread.

Calendar spread: Involves selling a near-term option and buying a longer-term option.

Diagonal spread: Similar to a calendar spread but with different strike prices.

Multi-leg trades:

Definition: Trades involving multiple options contracts.

Examples: Straddles, strangles, condors, and butterflies.

Advantages: Can provide more precise risk-reward profiles.

Options on different underlying assets:

Stock options: The most common type of options.

ETF options: Provide exposure to entire sectors or markets.

Index options: Based on stock market indexes like the S&P 500.

Futures options: Options on futures contracts, common in commodities trading.

Trading in various market conditions:

High volatility: Strategies like long straddles or strangles may be appropriate.

Low volatility: Consider strategies like iron condors or butterfly spreads.

Trending markets: Directional strategies like vertical spreads might be suitable.

Sideways markets: Look at neutral strategies like iron condors or calendar spreads.

Remember, these advanced concepts require thorough understanding and practice before implementation in real trading.

Successful options traders often specialize in a few advanced strategies that align with their trading style and risk tolerance.

Transitioning to Full-Time Options Trading

Moving from part-time to full-time options trading is a significant step.

Here's how to approach it:

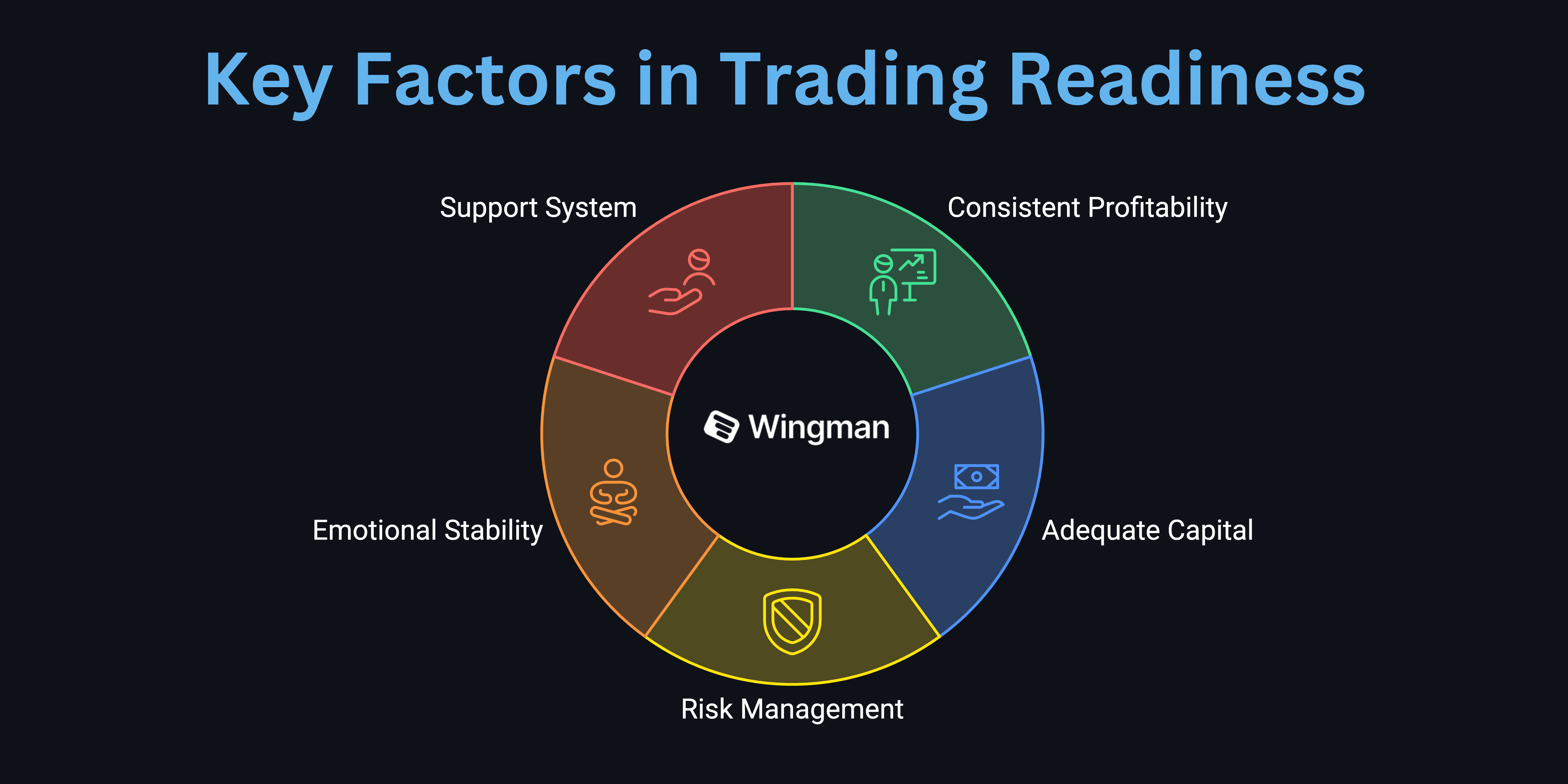

Assessing your readiness:

Consistent profitability: Ensure you've been consistently profitable over an extended period.

Adequate capital: Have enough trading capital and separate living expenses.

Risk management: Demonstrate solid risk management skills.

Emotional stability: Be prepared for the psychological challenges of full-time trading.

Support system: Have a supportive network of family and fellow traders.

Creating a transition plan:

Gradual transition: Start by reducing hours at your current job if possible.

Build a track record: Document your trading performance over time.

Develop multiple strategies: Have various strategies for different market conditions.

Establish a routine: Create a structured daily trading schedule.

Continuous education: Plan for ongoing learning and skill development.