Education

Quad Witching dates in 2024

by

Patricia

Oct 7, 2024

2

min read

Tired of Tracking Options Trades in a spreadsheet?

Try WingmanTracker Free for 30 Days

100% Money-Back Guarantee

Quadruple witching refers to the simultaneous expiration of stock index futures, stock index options, stock options, and single stock futures on the same day.

This significant event occurs four times a year, typically on the third Friday of March, June, September, and December.

Financial markets experience increased trading volume and potential market volatility during these periods as market participants rush to close out or roll over their expiring derivative positions.

The concept of quadruple witching evolved from triple witching, which only involved three types of expiring contracts.

The addition of single-stock futures in 2002 transformed it into quadruple witching, although single-stock futures stopped trading in the United States in 2020.

Despite this, the term "quadruple witching" is still commonly used in the financial world, though "triple witching" is now more accurate for U.S. markets.

Understanding Quadruple Witching

Quadruple witching involves the concurrent expiration of four types of derivative contracts:

Stock index futures: Contracts based on the future value of a stock market index.

Stock index options: Options contracts on stock market indices.

Stock options: Options contracts on individual stocks.

Single stock futures: Futures contracts on individual stocks (no longer traded in the U.S.).

The main difference between quadruple and triple witching is the inclusion of single stock futures.

Triple witching, which is now more common in the United States, only involves the expiration of stock index futures, stock index options, and stock options contracts.

Key players during quadruple witching include:

Market makers: Provide liquidity and facilitate trades.

Institutional investors: Manage large portfolios and may need to adjust positions.

Portfolio managers: Rebalance portfolios to align with benchmark indices.

Hedge funds: May exploit price discrepancies or adjust hedging strategies.

Retail traders: Individual investors who may be affected by or seek to profit from market movements.

These market participants contribute to the increased trading activity and potential market volatility associated with quadruple witching events.

Quadruple Witching Dates

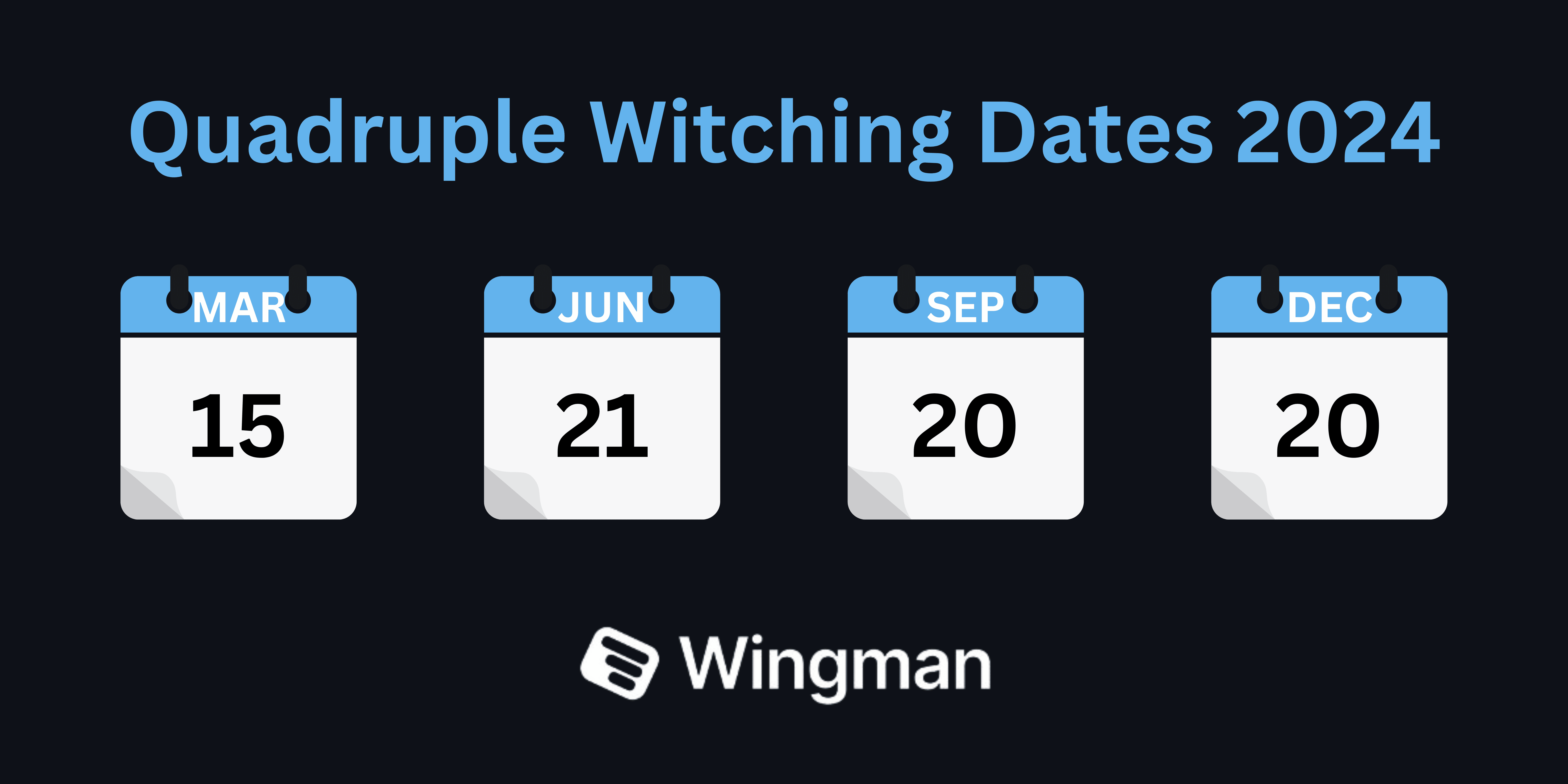

2024:

March 15, 2024

June 21, 2024

September 20, 2024

December 20, 2024

2025:

March 21, 2025

June 20, 2025

September 19, 2025

December 19, 2025

2026:

March 20, 2026

June 19, 2026

September 18, 2026

December 18, 2026

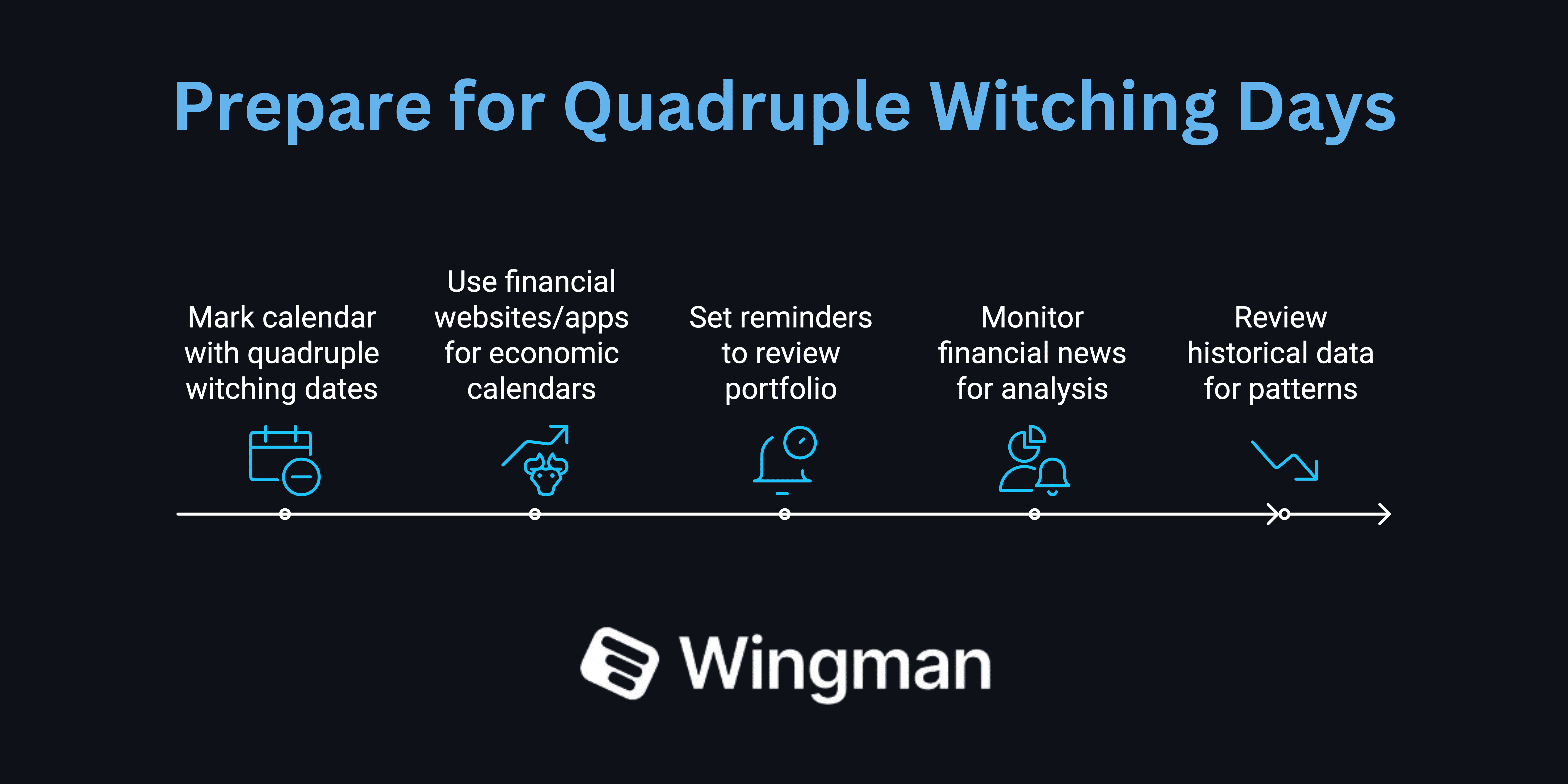

To track and prepare for upcoming quadruple witching dates:

Mark your calendar with the dates listed above.

Use financial websites or apps that provide economic calendars.

Set reminders a week before each date to review your portfolio.

Monitor financial news outlets for analysis and predictions leading up to these events.

Review historical trade data in your options tracker from previous quadruple witching days to identify trading patterns.

User research, and a wide variety of it, helps teams get as close as possible to the root of a user’s needs, over their wants. Studying responses on a larger scale is more work, but it helps form the foundation for true UX.

By staying informed about these quadruple witching dates, investors and traders can better prepare for potential market movements and adjust their investment strategies accordingly.

It's important to note that these dates represent a convergence of expirations for various financial instruments.

Market Impact of Quadruple Witching

Increased trading volume is a hallmark of quadruple witching days.

On average, trading volume can be 50% to 100% higher than on regular trading days.

This surge in activity is primarily due to the closing, rolling over, or offsetting of derivative positions.

Volatility patterns during quadruple witching can vary. While increased volatility is often expected, it's not guaranteed.

Some quadruple witching days may see relatively calm markets, while others experience significant price swings.

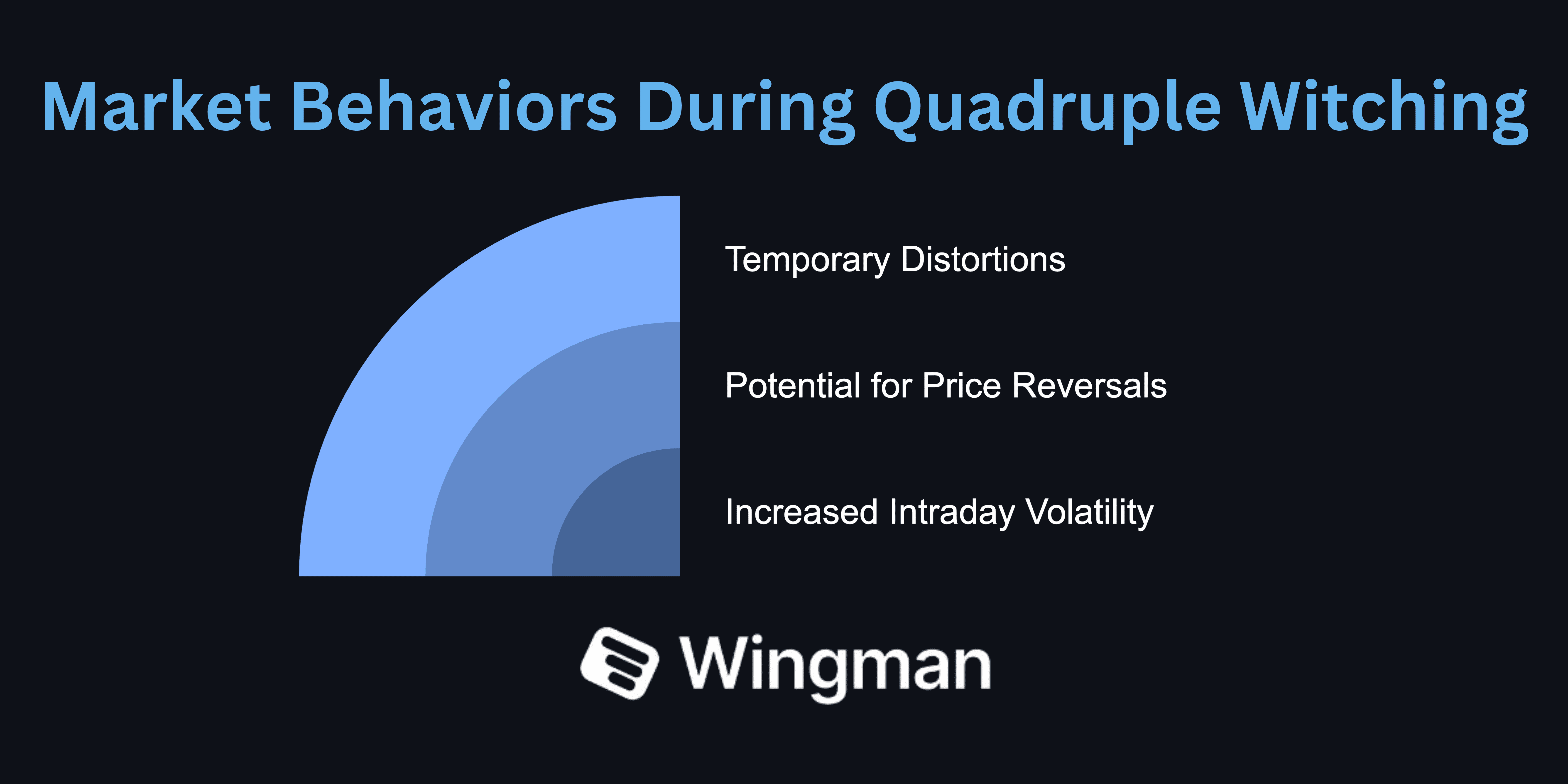

Price movements and trends during quadruple witching can be unpredictable.

Some common observations include:

Increased intraday volatility

Potential for price reversals near the close of trading

Temporary distortions in the relationship between derivatives and underlying assets

The impact on specific market sectors can differ.

Sectors with a high concentration of stocks with large open interest in options or futures may experience more pronounced effects.

Technology and financial sectors often see increased activity due to their weight in major indices and popularity among options traders.

It's important to note that the effects of quadruple witching are typically short-lived, with markets often returning to normal patterns within a few days following the event.

Long-term investors should be aware of these potential market fluctuations but may not need to take specific action unless it aligns with their overall investment strategy.

The "Witching Hour"

The "witching hour" refers to the final hour of trading on quadruple witching days, typically from 3:00 PM to 4:00 PM Eastern Time.

This period is significant because it's when much of the increased trading activity associated with quadruple witching occurs.

During the witching hour, traders and investors scramble to close out or roll over their expiring derivative positions.

This can lead to:

Sudden spikes in trading volume

Increased price volatility

Potential for large block trades

Rapid shifts in order flow

Last hour trading dynamics often include:

Heightened urgency among market participants

Increased algorithmic trading activity

Potential for short-term price dislocations

Historical examples of notable witching hours include:

June 19, 2020: The S&P 500 saw significant volatility in the final hour, with a 0.5% swing in the last 30 minutes of trading.

March 20, 2015: A surge in volume led to the second-highest trading day of that year, with over 10.8 billion shares changing hands.

While the witching hour can present opportunities for some traders, it also carries increased risks due to the potential for rapid price movements and reduced liquidity.

Investors should be cautious and consider implementing stop-loss orders to manage risk during this volatile period.

It's crucial to understand that trading during this time is not suitable for all investors and should only be considered by those with a high risk tolerance and a thorough understanding of the market dynamics at play.

Quadruple Witching vs. Regular Trading Days

Comparative analysis of volume shows that quadruple witching days consistently have higher trading volumes than regular trading days.

On average, volume can be 50% to 100% higher, with some instances seeing even greater increases.

Volatility differences between quadruple witching and regular trading days can vary:

Intraday volatility is often higher on quadruple witching days, especially during the last hour of trading.

Overall daily volatility may not always be significantly different from regular trading days.

The VIX (Volatility Index) may show elevated levels leading up to and during quadruple witching days.

Price action patterns on quadruple witching days can differ from regular trading days:

More frequent and larger price swings, particularly in the last hour of trading.

Potential for price reversals or "pinning" near option strike prices.

Temporary disconnects between derivative prices and underlying asset prices.

Increased likelihood of gap openings on the following trading day.

It's important to note that while these patterns are common, they are not guaranteed.

Market conditions, economic news, and other factors can influence how quadruple witching days compare to regular trading days.

Traders and investors should be aware of these differences when planning their strategies around quadruple witching events.

However, it's crucial to remember that past performance does not guarantee future results, and all trading carries inherent risks.

Strategies for Trading During Quadruple Witching

Risk management techniques for quadruple witching include:

Setting tighter stop-loss orders to protect against increased volatility.

Reducing position sizes to limit exposure to potential price swings.

Using options strategies like straddles or iron condors to potentially profit from volatility.

Avoiding entering new large positions just before or during the witching hour.

Consider implementing option strategies that manage risk during volatile periods like quadruple witching.

Arbitrage opportunities may arise due to temporary price discrepancies:

Index arbitrage between futures and underlying stocks.

Options-futures arbitrage.

Cross-market arbitrage between related instruments.

Hedging strategies to consider:

Using inverse ETFs to hedge long positions.

Implementing collar strategies to protect gains.

Employing protective puts on existing long stock positions.

Sector-specific approaches:

Focus on sectors with high options open interest.

Monitor sector ETFs for potential overreactions to quadruple witching effects.

Consider pair trades between related sectors to capitalize on relative value discrepancies.

Remember that these trading strategies carry risks and may not be suitable for all investors.

It's crucial to thoroughly understand the mechanics of quadruple witching and its potential impacts before implementing any trading strategy.

Additionally, investors should always consider their personal circumstances and financial situation before making any investment decisions.

Backtesting Quadruple Witching Performance

Historical returns analysis of quadruple witching days reveals mixed results:

Some studies show slightly positive average returns on quadruple witching days.

Others indicate no statistically significant difference in returns compared to regular trading days.

The impact on returns may vary depending on the broader market conditions and economic factors.

Win rate statistics for various strategies during quadruple witching:

Day trading strategies may show higher win rates due to increased intraday volatility.

Mean reversion strategies often perform well in the days following quadruple witching.

Trend-following strategies may struggle due to potential whipsaw price action.

Volatility backtests indicate:

Implied volatility tends to increase leading up to quadruple witching days.

Realized volatility is often higher on quadruple witching days, especially in the last hour of trading.

Volatility typically normalizes within a few days after the event.

Volume pattern analysis shows:

Consistent spikes in trading volume on quadruple witching days.

Volume tends to build throughout the day, peaking in the final hour.

Certain stocks and ETFs with high options open interest see more pronounced volume increases.

These backtest results can help traders and investors better understand the historical patterns associated with quadruple witching events and adjust their strategies accordingly.

However, it's important to note that backtesting results are based on historical data and may not accurately predict future market behavior.

Quadruple Witching and Options

Impact on options pricing:

Implied volatility often increases leading up to quadruple witching, affecting option premiums.

Time decay accelerates for expiring options, potentially creating opportunities for option sellers.

Bid-ask spreads may widen, especially for less liquid options.

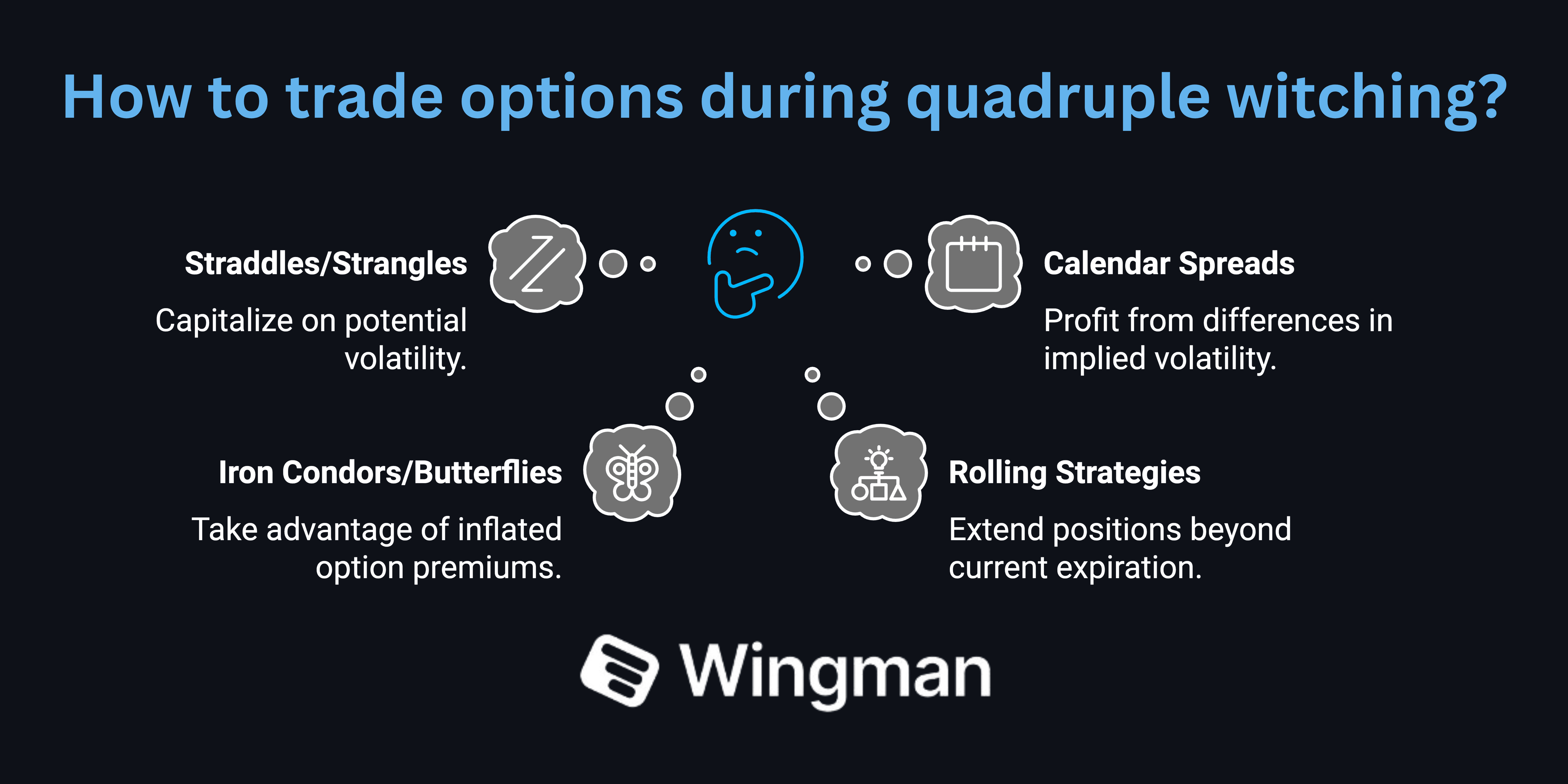

Strategies for options traders during quadruple witching:

Straddles and strangles to capitalize on potential volatility.

Calendar spreads to profit from differences in implied volatility across expiration dates.

Iron condors or iron butterflies to take advantage of potentially inflated option premiums.

Rolling strategies to extend positions beyond the current expiration.

Pin risk and how to manage it:

Pin risk occurs when the underlying asset price closes near an option's strike price at expiration, making it unclear whether the option will be exercised.

To manage pin risk:

Close out at-risk positions before expiration.

Use limit orders to exit positions, as market orders may be risky during volatile periods.

Consider using European-style options, which can only be exercised at expiration.

Monitor positions closely and be prepared to make quick decisions.

Options traders should be particularly vigilant during quadruple witching due to the potential for increased volatility and unusual price movements in the underlying assets.

It's crucial to understand the risks associated with options trading and to adhere to applicable risk disclosures provided by brokers and exchanges.

Global Perspective on Quadruple Witching

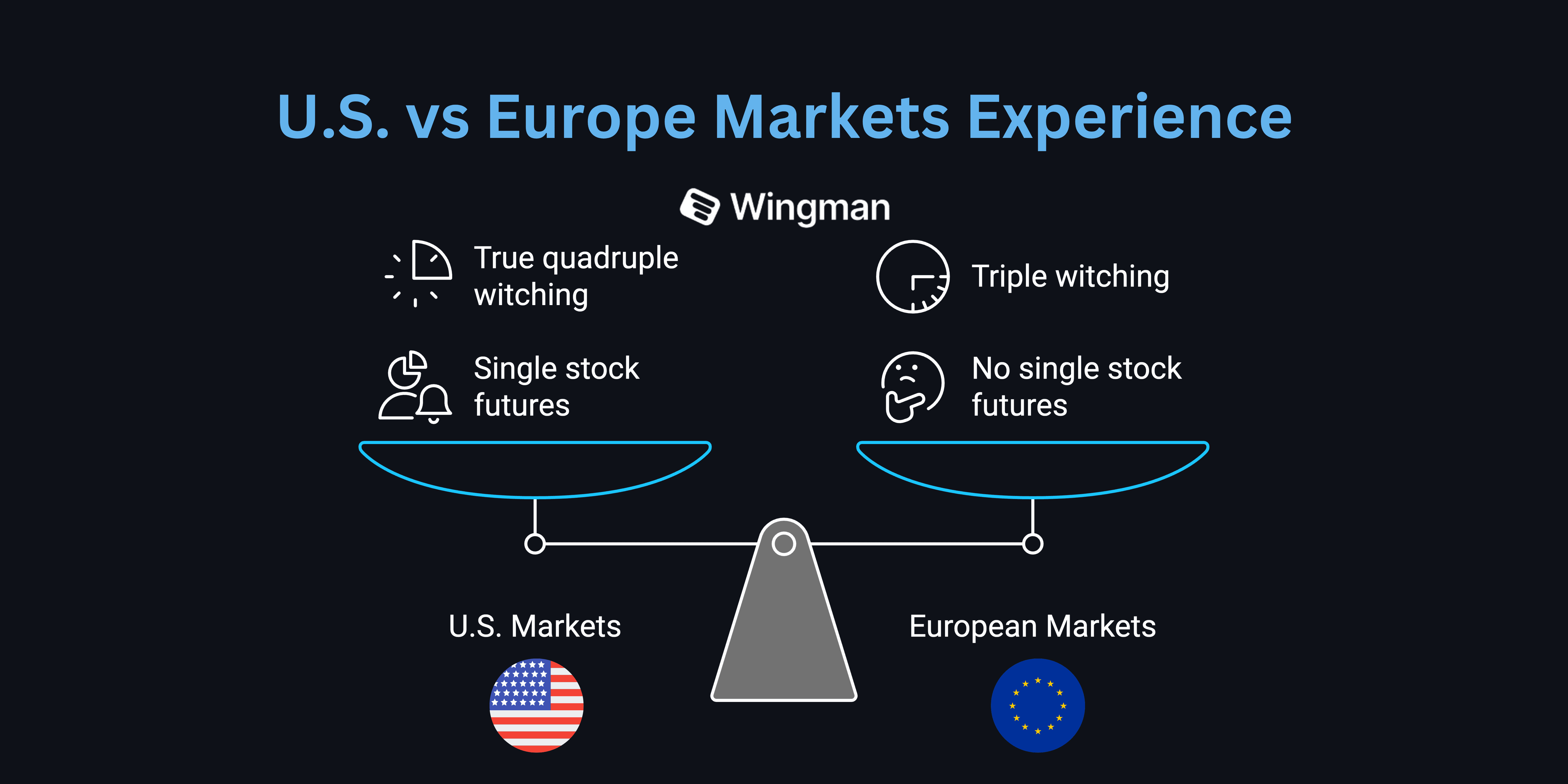

Comparison with other major markets:

U.S. markets experience true quadruple witching due to the presence of single stock futures.

European markets have similar events, often called "triple witching" or "rolling week."

Asian markets may have their own versions of multiple contract expirations, but they're generally less prominent than in the United States.

International trading considerations:

Currency fluctuations can impact the value of international derivatives during quadruple witching.

Time zone differences may affect the ability of international traders to participate in U.S. quadruple witching events.

Some international exchanges adjust their trading hours to accommodate U.S. quadruple witching.

Cross-market effects:

Increased volatility in U.S. markets during quadruple witching can spill over into international markets.

Global ETFs and ADRs may see heightened activity as traders adjust positions across markets.

Correlation between markets may temporarily increase during these events.

Traders operating in multiple markets should be aware of the potential ripple effects of U.S. quadruple witching on global markets.

This awareness can help in developing more comprehensive trading strategies and risk management approaches for various asset classes, including both traditional financial instruments and digital assets like cryptocurrencies.

Technology and Quadruple Witching

Role of algorithmic trading:

Algorithms handle a significant portion of trading volume during quadruple witching.

They can quickly execute complex strategies and manage multiple expiring positions.

Some algorithms are specifically designed to capitalize on quadruple witching patterns.

High-frequency trading impact:

HFT firms may increase their activity during quadruple witching to profit from small price discrepancies.

This can lead to faster price adjustments but may also contribute to short-term volatility.

HFT can provide additional liquidity during high-volume periods.

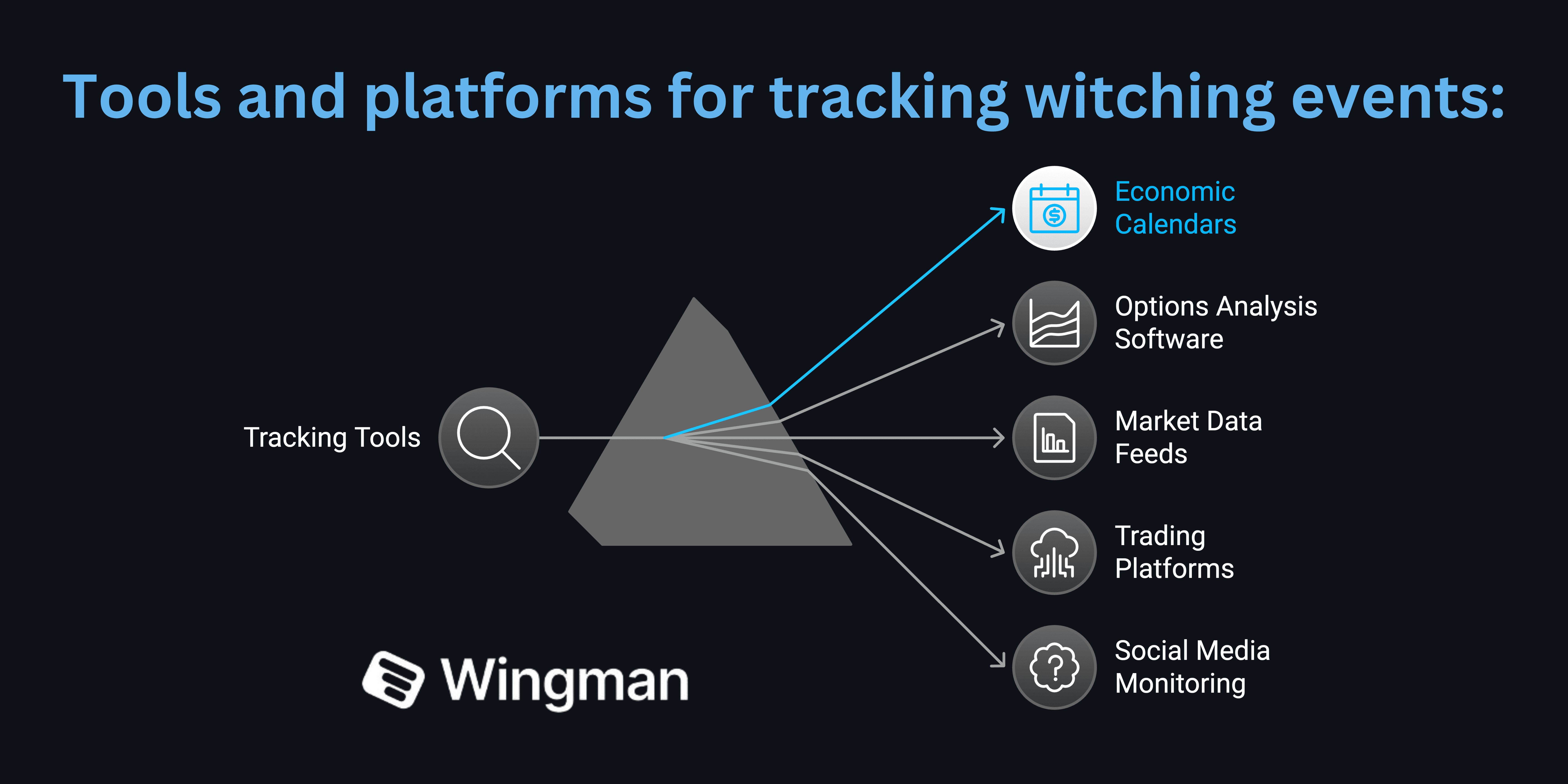

Tools and platforms for tracking witching events:

Economic calendars on financial websites and apps.

Options analysis software that highlights expiration dates and open interest.

Real-time market data feeds with volume and volatility indicators.

Trading platforms with customizable alerts for quadruple witching-related metrics.

Social media monitoring tools to gauge market sentiment around these events.

As technology continues to evolve, its role in quadruple witching events is likely to grow.

Traders and investors should stay informed about technological advancements and how they might affect market dynamics during these periods.

This includes understanding the impact of electronic storage media and tasty software solutions that may be used by various market participants.

Regulatory Considerations

SEC regulations related to quadruple witching:

The SEC monitors for potential market manipulation during high-volume periods like quadruple witching.

Circuit breakers and trading halts remain in effect to prevent extreme price movements.

Reporting requirements for large traders help regulators track significant market participants.

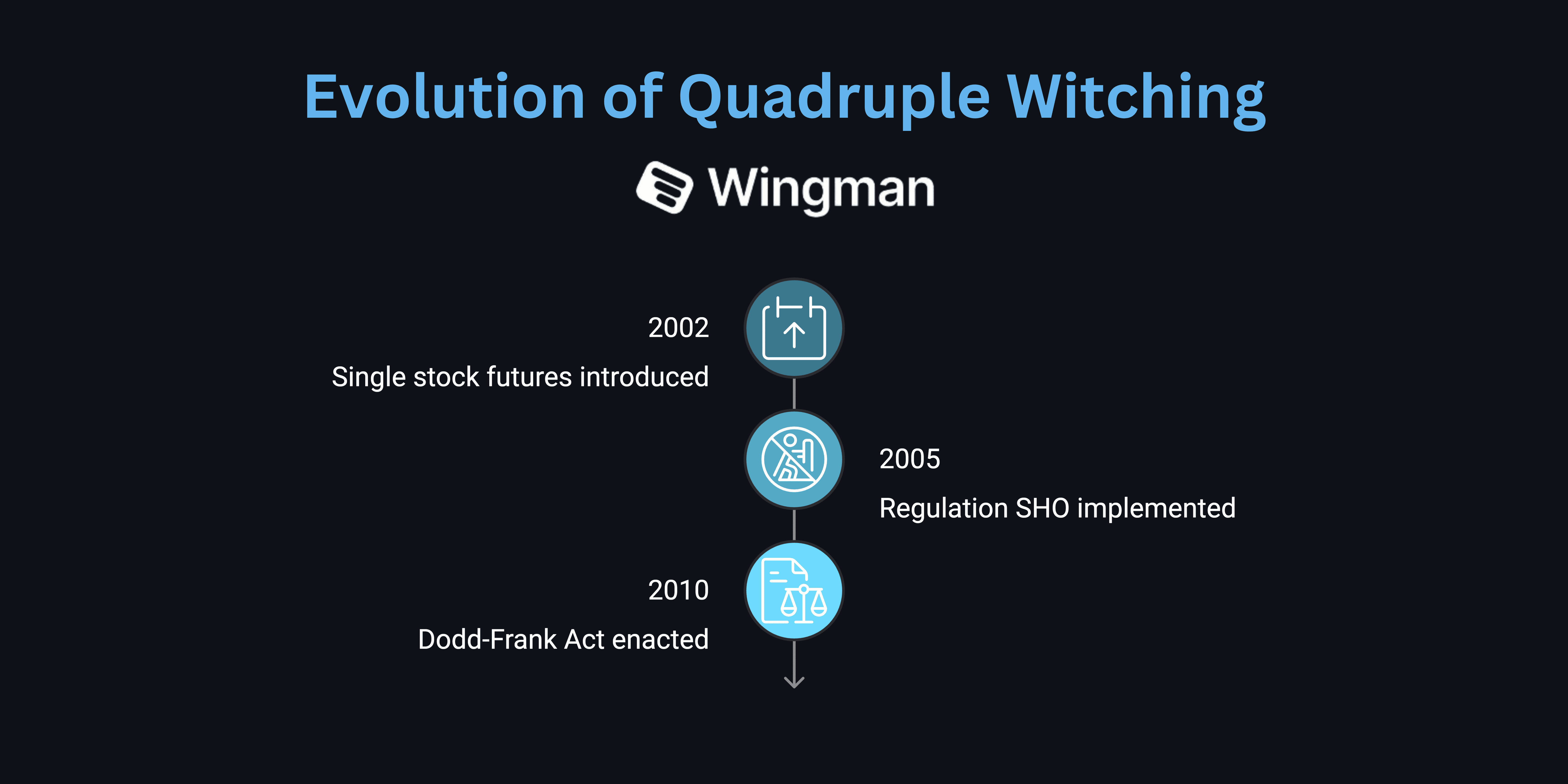

Historical regulatory changes:

Introduction of single stock futures in 2002, which created quadruple witching from triple witching.

Implementation of Regulation SHO in 2005, affecting short selling practices during expiration periods.

Dodd-Frank Act of 2010 introduced new regulations for derivatives trading, impacting quadruple witching dynamics.

Potential future regulatory developments:

Increased scrutiny of high-frequency trading during high-volume events.

Possible adjustments to margin requirements for expiring contracts.

Enhanced reporting requirements for large derivative positions.

Potential changes to settlement procedures to reduce expiration-related volatility.

Market participants should stay informed about current and potential future regulations that may affect quadruple witching events.

Compliance with these regulations is crucial for maintaining market integrity and avoiding penalties.

It's important to note that registered broker-dealers and other financial institutions may have additional compliance requirements related to quadruple witching activities.

Expert Insights and Predictions

Interviews with market analysts reveal:

Mixed opinions on the long-term significance of quadruple witching.

Some see it as an opportunity for increased profits, while others view it as a potential source of unnecessary volatility.

Many emphasize the importance of preparation and risk management during these events.

Professional traders' perspectives:

Experienced traders often reduce position sizes leading up to quadruple witching.

Some focus on specific strategies, such as volatility plays or arbitrage opportunities.

Many stress the importance of staying flexible and adapting to changing market conditions during these periods.

Academic research findings:

Studies show that the impact of quadruple witching on overall market returns is generally short-lived.

Research indicates that individual stocks with high options open interest are more likely to experience significant price movements.

Some academics argue that the effects of quadruple witching have diminished over time as markets have become more efficient.

These expert insights can provide valuable context for traders and investors as they navigate quadruple witching events.

However, it's important to remember that market conditions can change, and past performance may not always predict future outcomes.

Investors should always consider seeking professional investment advice tailored to their individual circumstances.