Education

Option Wheel Strategy

by

Oct 12, 2024

2

min read

Tired of Tracking Options Trades in a spreadsheet?

Try WingmanTracker Free for 30 Days

100% Money-Back Guarantee

The options wheel strategy is a methodical approach to options trading that aims to generate consistent income.

This systematic approach combines selling cash-secured puts and covered calls on the same underlying stock, allowing investors to earn regular income while managing risk in various market conditions.

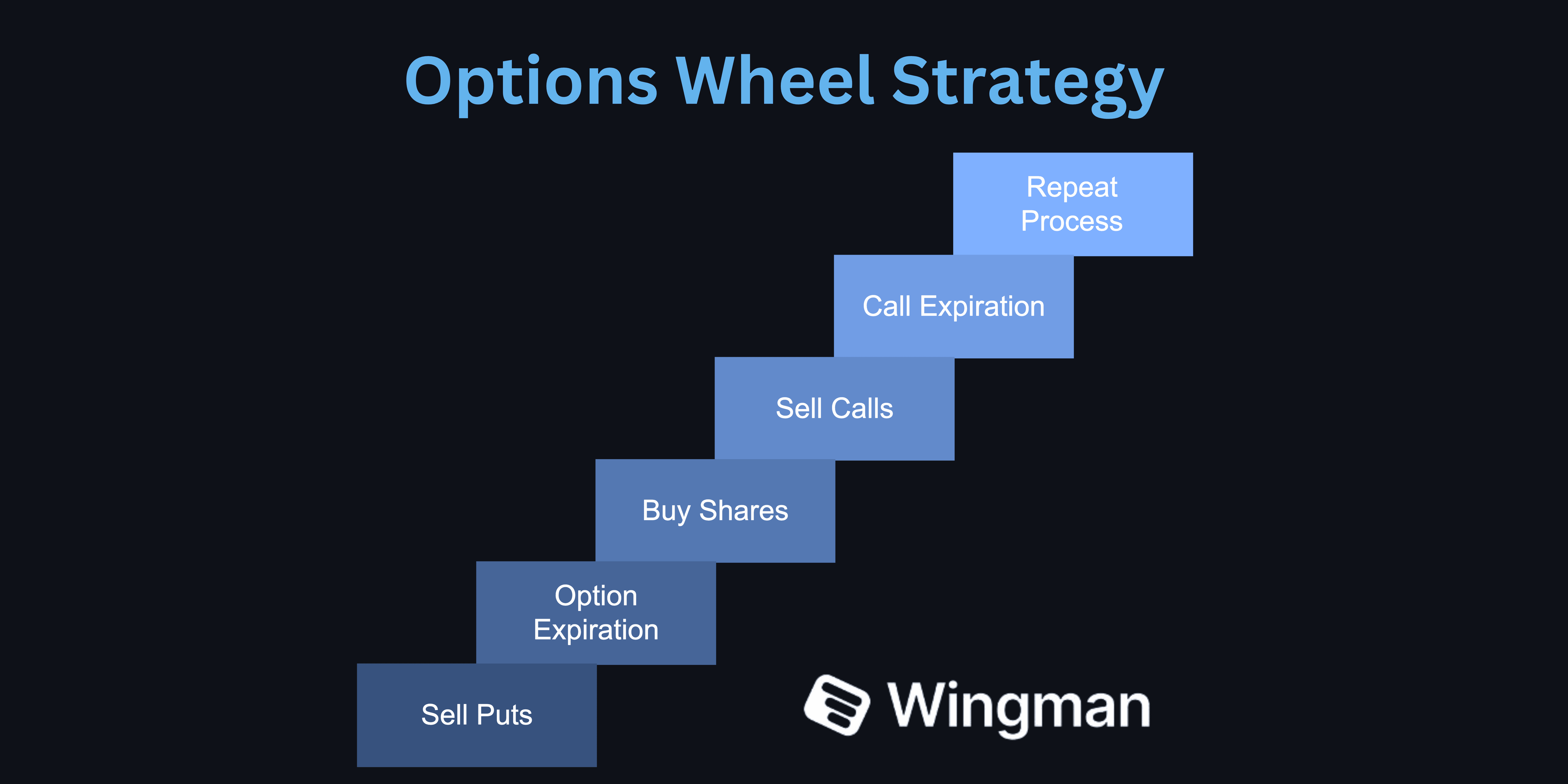

Here's how the options wheel strategy works:

Sell cash-secured puts on a stock you're willing to own.

If the option expires worthless, keep the premium and repeat.

If assigned, buy the stock at the strike price (your set purchase price).

Once you own shares of the stock, sell covered calls above your cost basis.

If the call expires worthless, keep the premium and sell another call.

If the call is exercised, sell your shares at the strike price.

Return to step 1 and repeat the process.

This strategy is particularly appealing to investors who:

Seek steady income from their portfolio

Are comfortable with options trading

Have a long-term outlook on specific stocks

Want to actively manage their investments

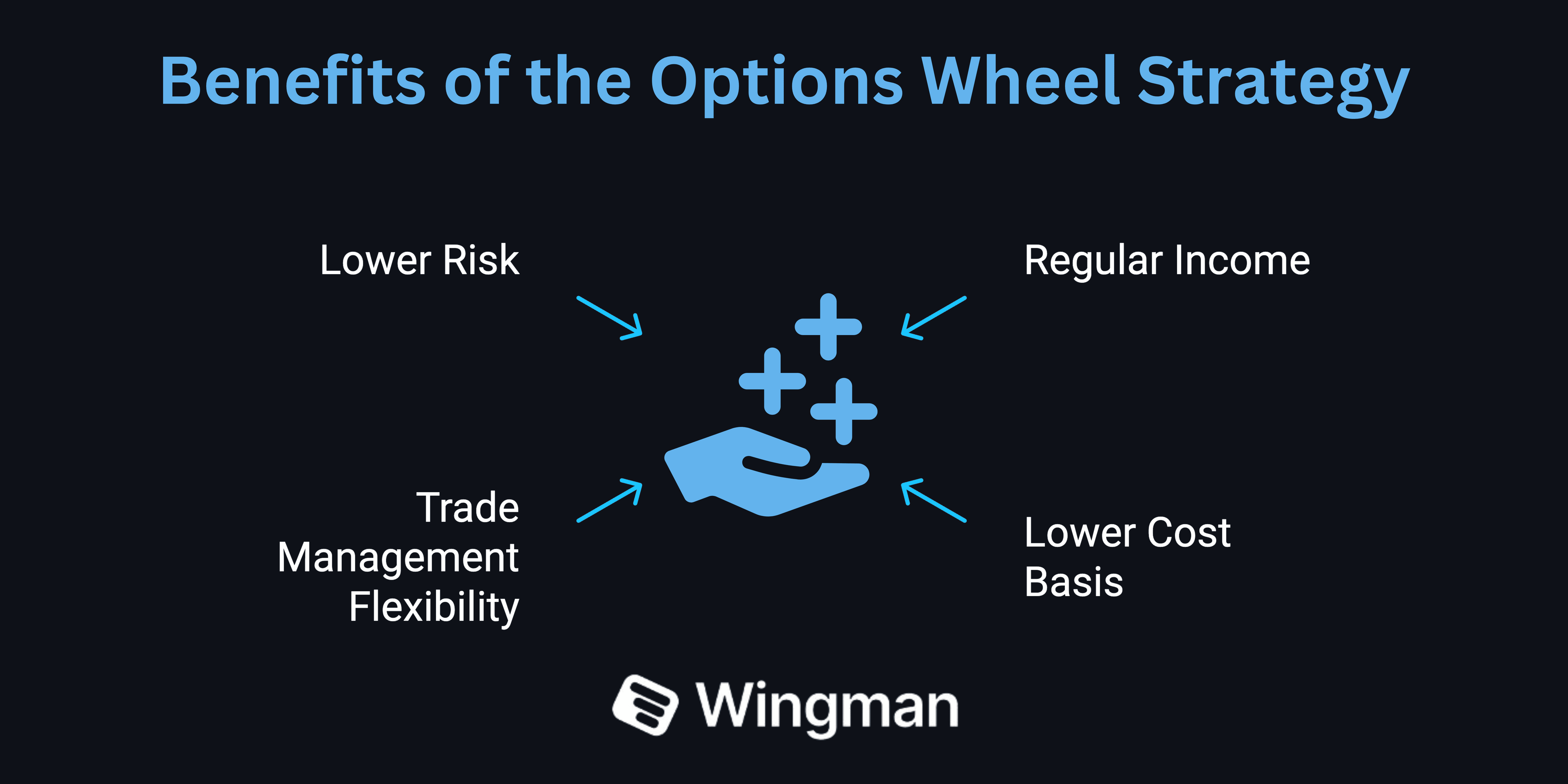

Benefits of the options wheel strategy include:

Regular income generation through option premiums

Potential to lower cost basis over time

Flexibility in managing trades based on current market conditions

Lower risk compared to some other options strategies

While the options wheel can be an effective tool for generating income, it's crucial to understand its mechanics, risks, and potential rewards before implementation.

This guide will provide a comprehensive overview of the strategy, from basic concepts to advanced techniques and real-world applications.

Option Wheel Strategy - The Basics

The options wheel strategy revolves around two key components: cash-secured puts and covered calls.

Understanding these elements is crucial for successful implementation of the strategy.

Key components of the wheel strategy

Cash-Secured Puts: This involves selling put options on stocks you're willing to buy at a lower price. The "cash-secured" part means having enough cash in your account to purchase the shares if the option is exercised. When you sell a put, you receive a premium, which is your potential profit if the option expires worthless.

Covered Calls: Once you own shares of the stock (either through put assignment or direct purchase), you can sell call options against those shares. This is called a covered call because you own the underlying stock to "cover" the potential obligation to sell if the call is exercised. You receive a premium for selling the call, which provides additional income.

How the options wheel strategy works

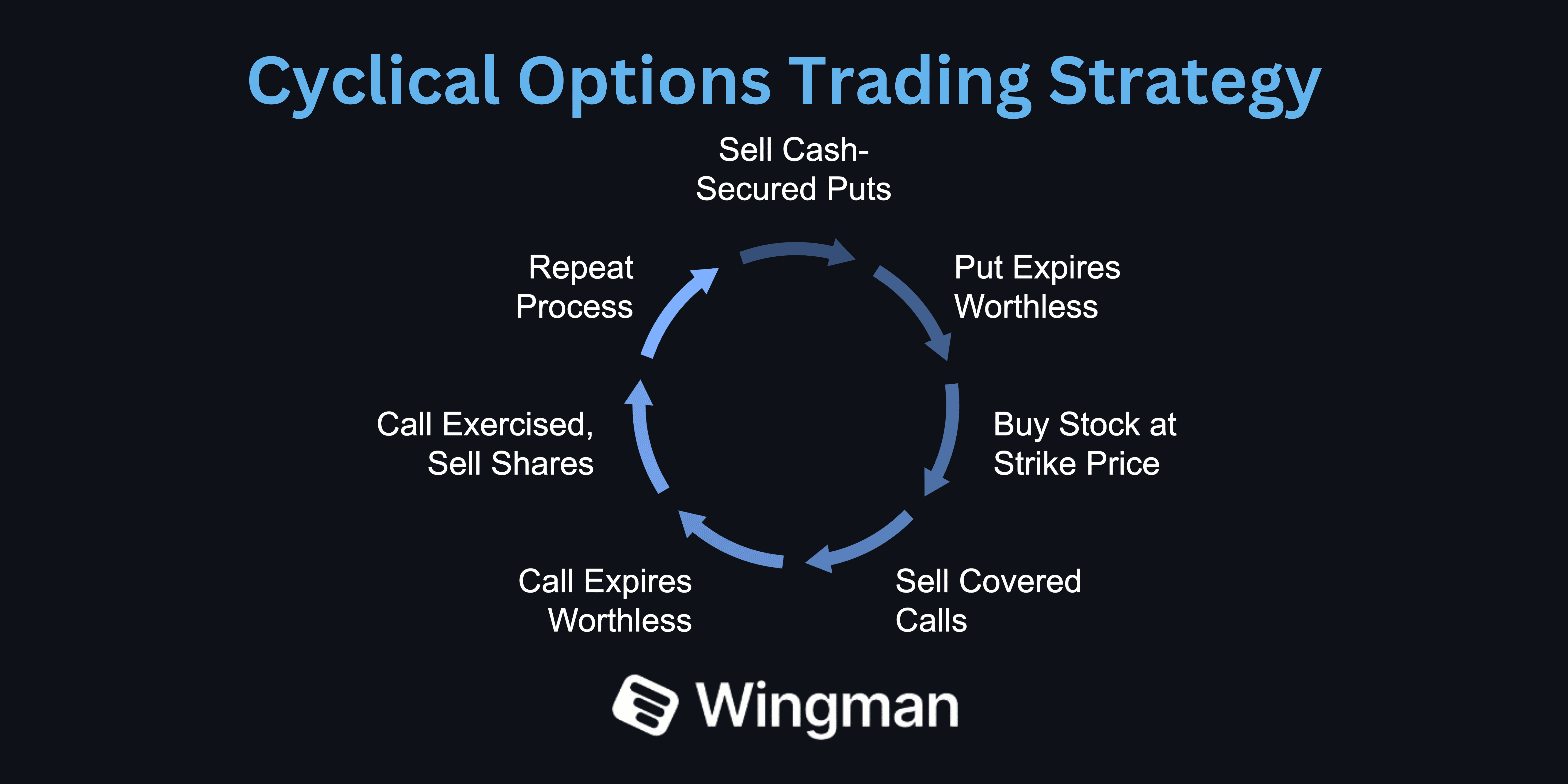

The strategy operates in a cyclical manner:

Sell cash-secured puts on a stock you want to own.

If the put expires worthless, keep the entire premium and repeat step 1.

If assigned, you buy the stock at the strike price (your set purchase price).

Once you own the stock, sell covered calls above your cost basis.

If the call expires worthless, keep the premium and repeat step 4.

If the call is exercised, sell your shares at the strike price.

Return to step 1 and repeat the process.

This cycle creates a "wheel" of ongoing income opportunities, hence the name "options wheel strategy."

Risk profile compared to other options strategies

The wheel strategy generally carries lower risk than more complex options strategies.

It provides a methodical approach to options trading with a focus on risk management.

However, it's not without risks:

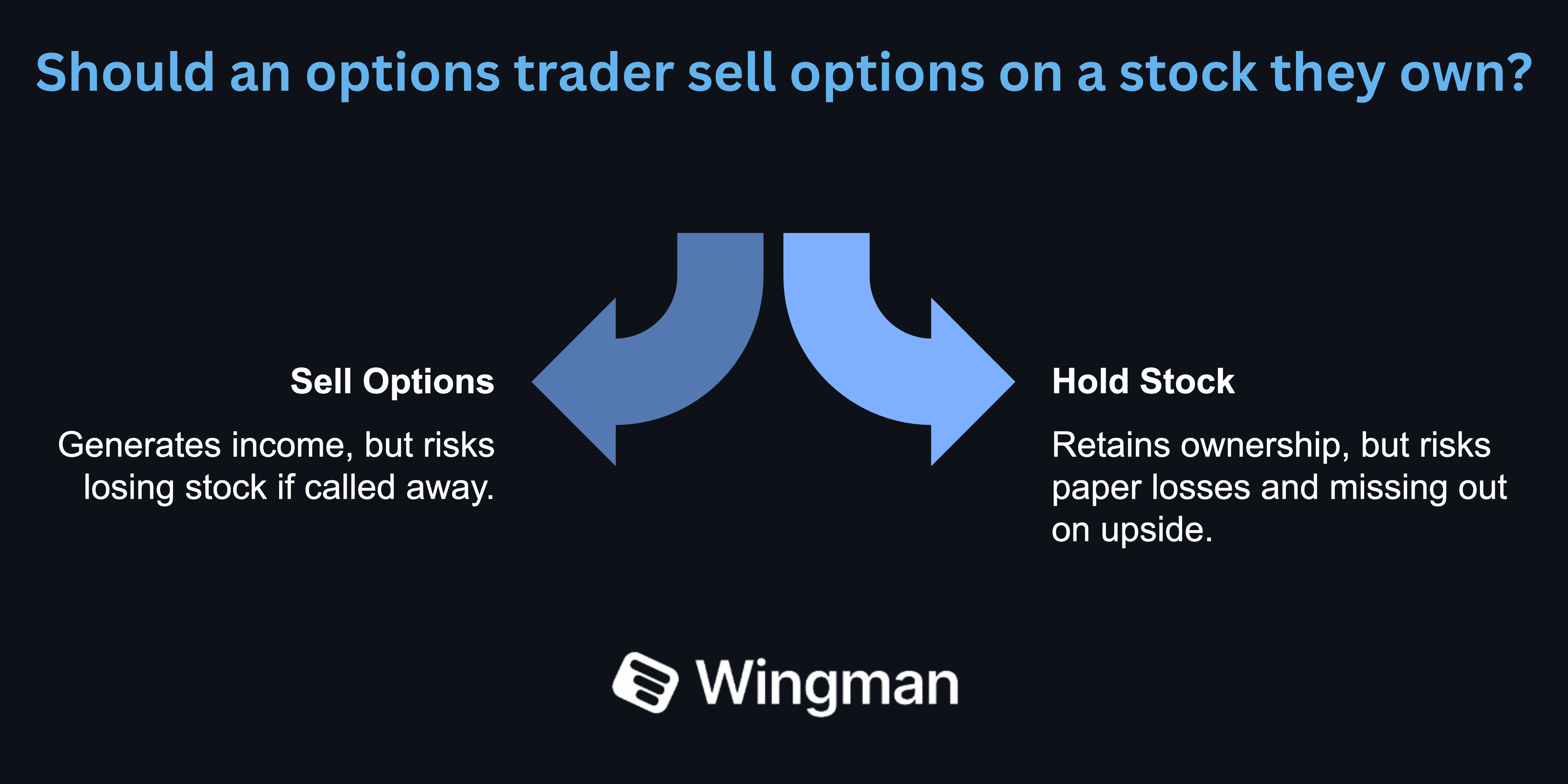

The underlying stock could decline significantly, leading to paper losses.

You might miss out on substantial upside if your shares are called away.

Time decay works in your favor when selling options, but against you when holding stock.

Compared to strategies like naked calls or puts, iron condors, or straddles, the wheel strategy is more conservative and easier to manage for most options traders.

It's often considered a good candidate for those looking to generate consistent income from their portfolio.

Getting Started with the Wheel Strategy

Implementing the options wheel strategy requires careful preparation and consideration. Here's how to get started:

Selecting the right stocks

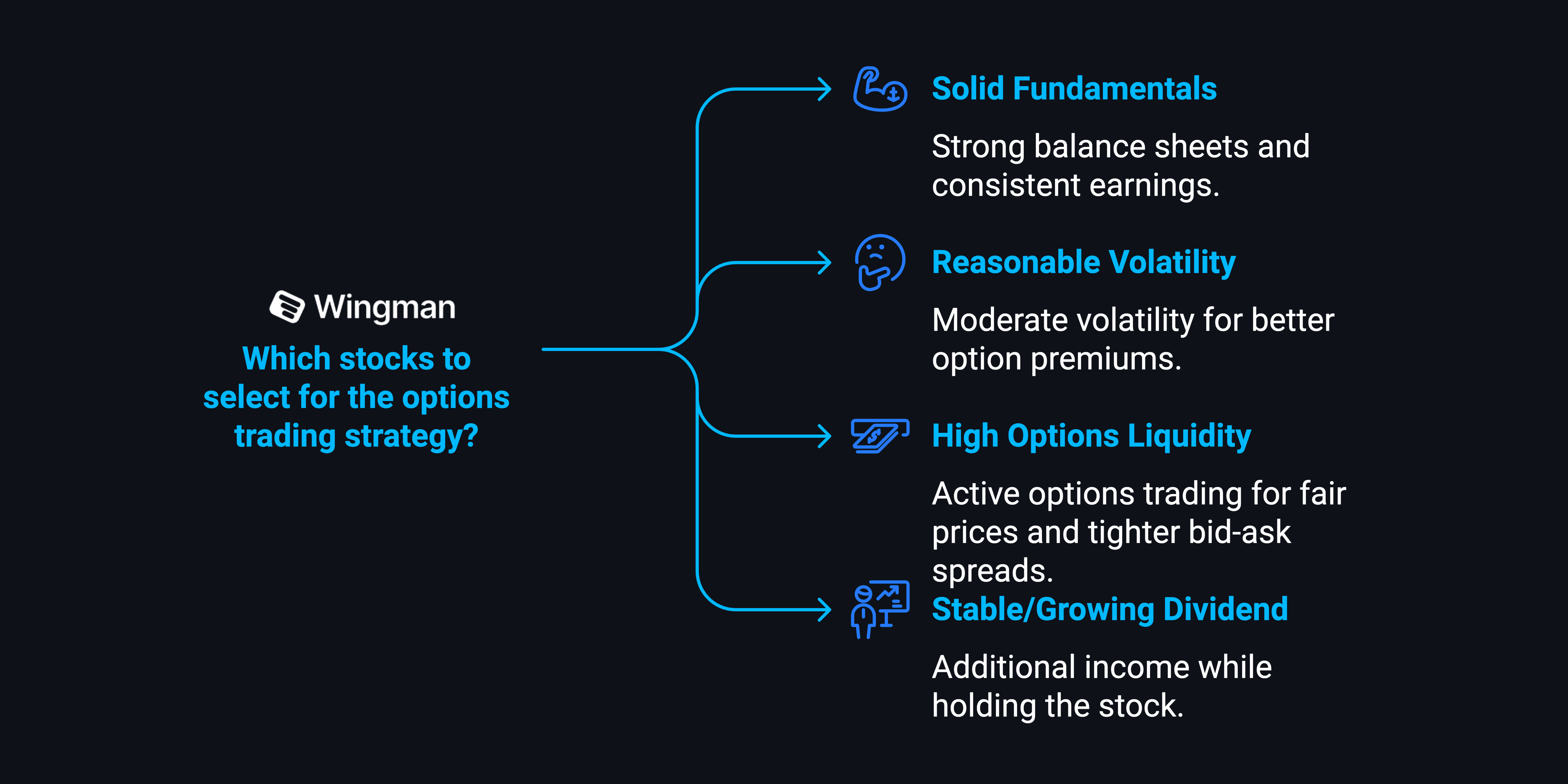

Criteria for choosing wheel-friendly stocks:

Solid fundamentals: Look for companies with strong balance sheets and consistent earnings.

Reasonable volatility: Stocks with moderate volatility often provide better option premiums.

High options liquidity: Ensure the stock has active options trading to get fair prices and tighter bid-ask spreads.

Stable or growing dividend: This can provide additional income while holding the stock.

Importance of fundamental analysis: Review company finances, earnings reports, and market position.

This helps identify suitable stocks you'd be comfortable owning long-term if assigned.

Consider factors like:

Price-to-earnings ratio

Debt-to-equity ratio

Revenue and earnings growth

Competitive advantages in the industry

Determining position size and portfolio allocation

Start small: Begin with a small portion of your portfolio to learn the strategy.

Use the 1% rule: Risk no more than 1% of your portfolio on any single trade.

Diversify: Don't concentrate too much in one sector or stock.

Account for assignment: Ensure you have enough cash for potential stock purchases.

Setting up your brokerage account for options trading

Choose a broker that offers:

Competitive commissions on options trades

Good research tools and educational resources

Easy-to-use platforms for executing options trades

Real-time data and analytics

Approval for the appropriate options trading level

Integrates well with an options trade tracker.

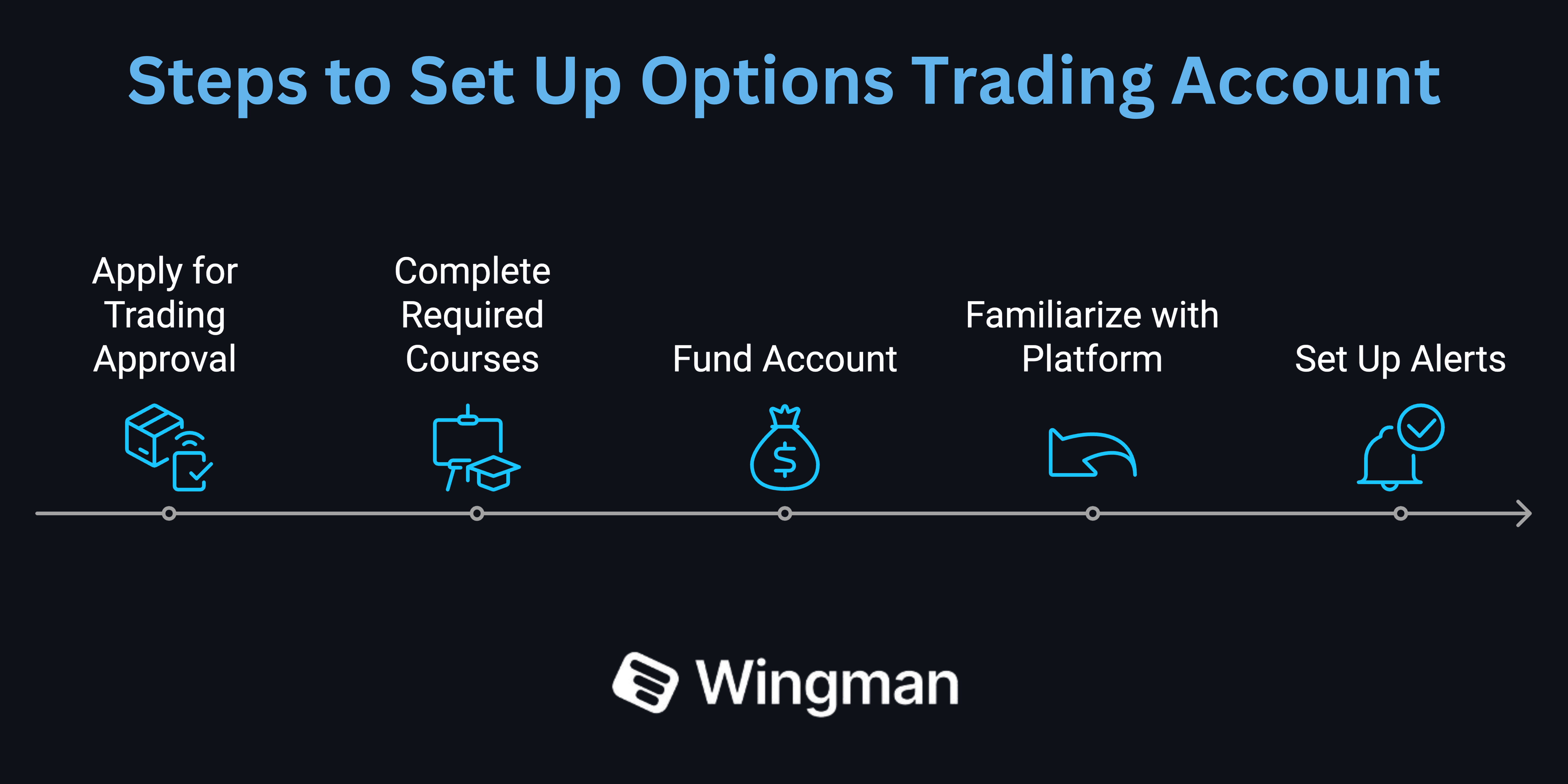

Steps to set up your account:

Apply for options trading approval with your broker.

Complete any required options trading courses or tests.

Fund your account with sufficient capital for cash-secured puts.

Familiarize yourself with the trading platform and order types.

Set up alerts for price movements and option expiration dates.

Remember, successful implementation of the wheel strategy requires a solid foundation.

Take time to thoroughly research and prepare before executing your first trade.

This methodical approach will help you build a custom wheel strategy that aligns with your investment goals and risk tolerance.

Step-by-Step Guide to Implementing the Wheel Strategy

Executing the options wheel strategy involves a series of steps. Here's a detailed guide to help you implement the strategy effectively:

Selling cash-secured puts

Choosing the right strike price:

Select a strike price below the current market price of the underlying stock.

Consider a price at which you'd be comfortable buying the stock.

Balance between premium income and likelihood of assignment.

Example: If XYZ stock trades at $100, you might sell a put at $95 strike.

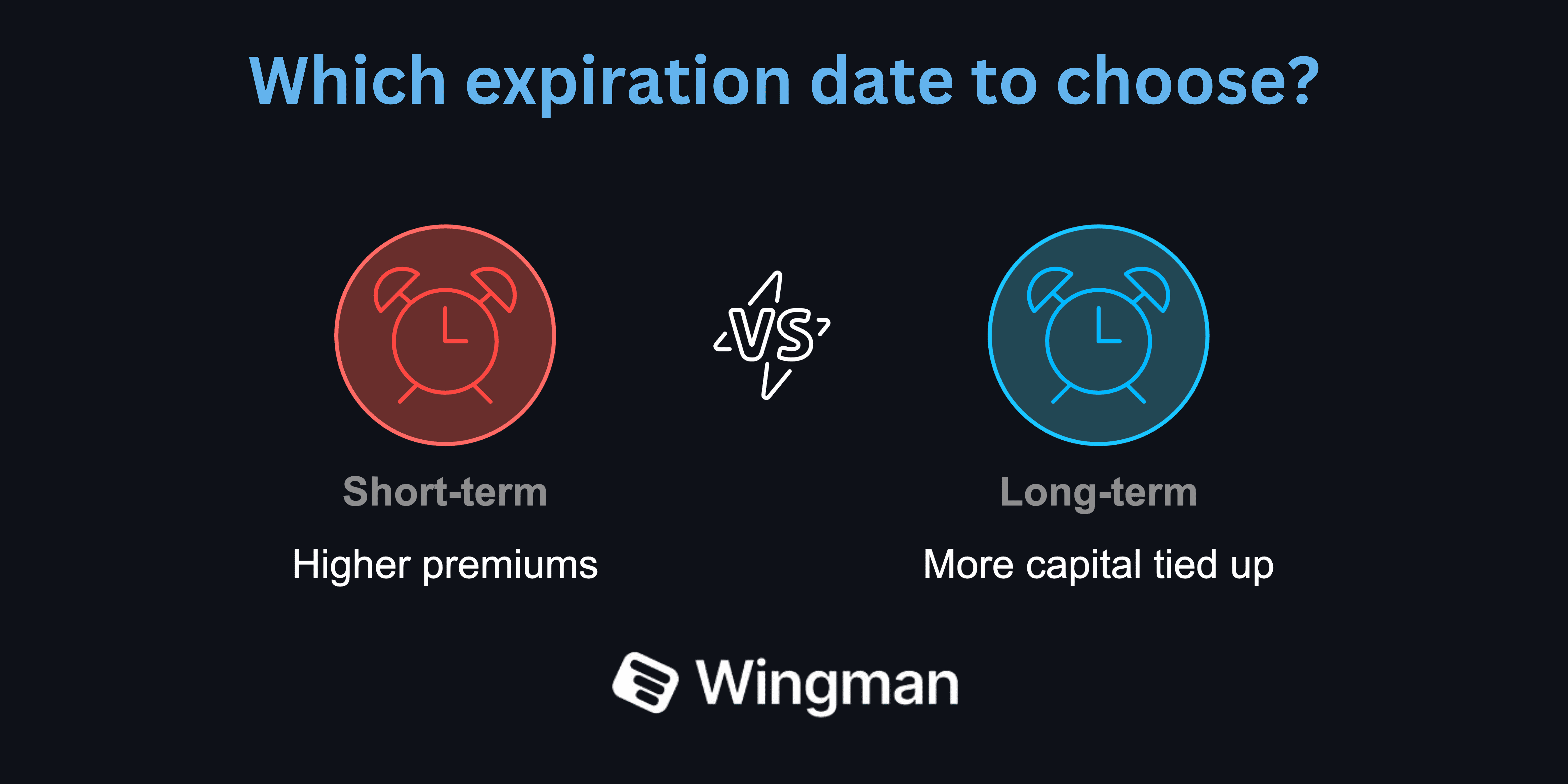

Selecting expiration dates:

Short-term expirations (30-45 days) often yield higher annualized premiums.

Longer expirations provide more premium but tie up capital for an extended period.

Consider upcoming events like earnings reports when choosing expiration dates.

Understanding and using delta:

Delta indicates the probability of the option expiring in-the-money.

A delta of 0.30 suggests a 30% chance of assignment.

Lower delta means less premium but lower chance of assignment.

Example: A put with 0.20 delta might be a good balance of premium and risk.

Managing assigned stock positions

If assigned, you now own the stock at the strike price minus the premium received.

Evaluate the current market conditions and stock's price performance.

Consider selling covered calls immediately or waiting for a price rebound.

Example: If assigned 100 shares at $95 and received $2 premium, your cost basis is $93 per share.

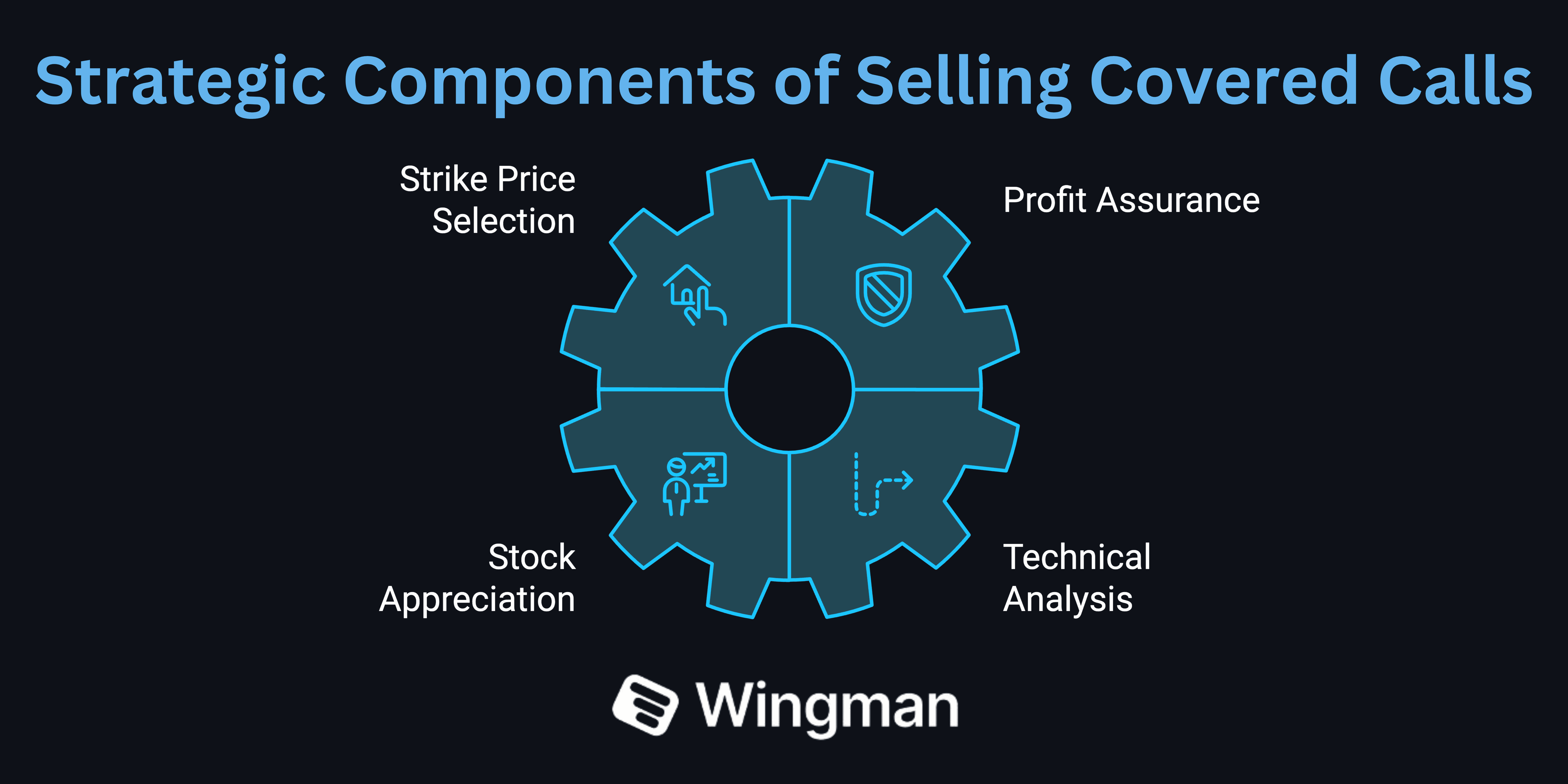

Selling covered calls

Strike price selection for covered calls:

Choose a strike price above your cost basis to ensure a profit if called away.

Balance between potential stock appreciation and option premium.

Consider using technical analysis to identify resistance levels.

Example: If your cost basis is $93, you might sell a call at $100 strike.

Rolling covered calls:

If the stock approaches your strike price near expiration, consider rolling.

Buy back the current call and sell a new one at a higher strike price or later expiration.

This can help avoid assignment and capture additional premium.

Example: Roll a $100 call to a $105 call for the next month, collecting more premium.

Repeating the cycle

After a successful covered call (either expired or assigned), return to selling puts.

Continuously evaluate the underlying stock's performance and adjust your strategy.

Keep track of your overall cost basis and profits from option premiums.

Example: If your shares are called away at $100, you might start selling puts at $95 again.

Remember, patience and discipline are key in the options wheel strategy.

Don't force trades if market conditions aren't favorable. Sometimes, waiting for better opportunities is the best action.

This systematic approach can help you generate consistent income over time, but it requires ongoing management and adjustment based on market conditions and the performance of your chosen stocks.

Advanced Techniques for the Wheel Strategy

As you become more comfortable with the basic wheel strategy, you can incorporate advanced techniques to potentially enhance returns and manage risk more effectively.

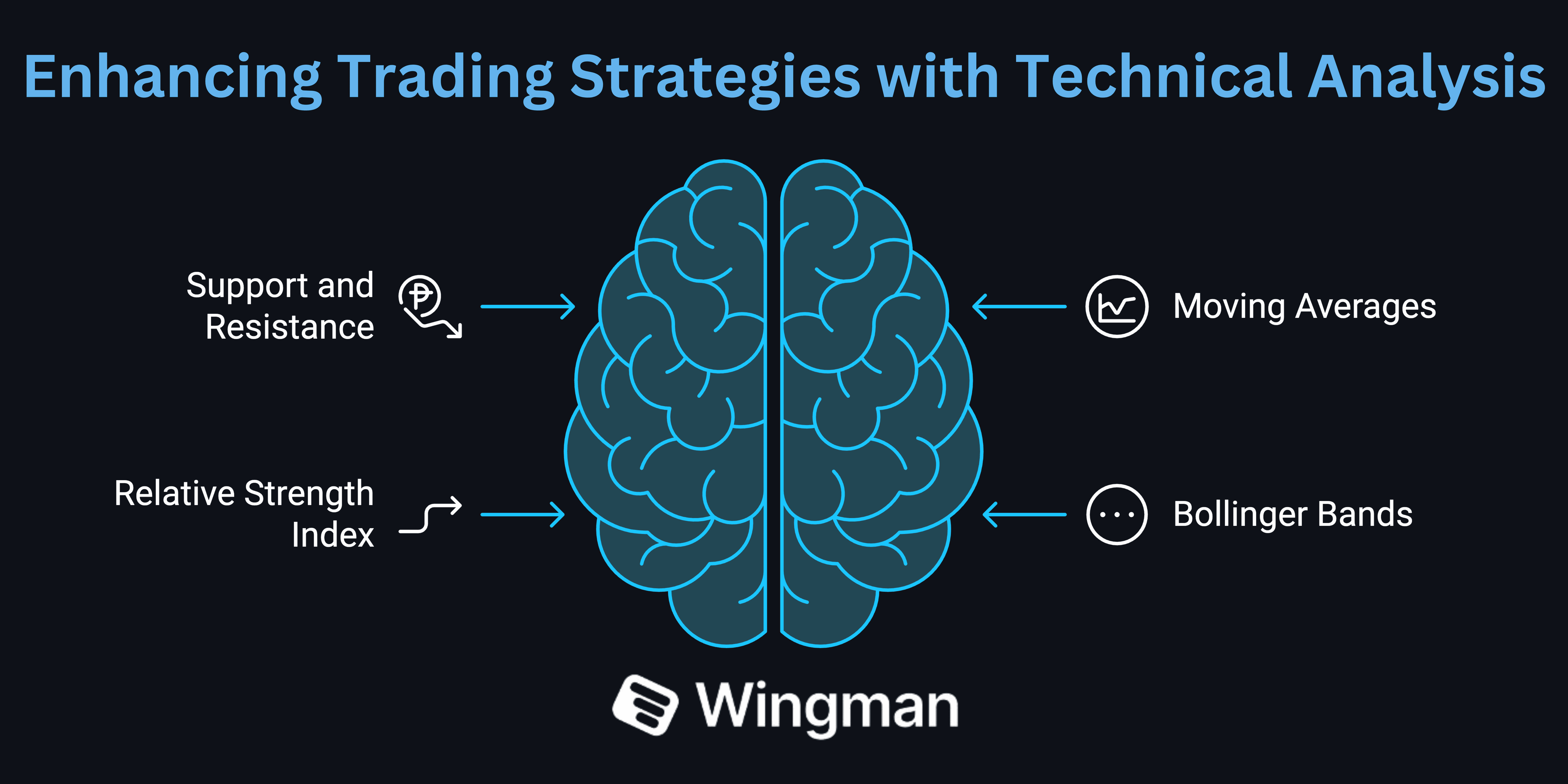

Using technical analysis to improve entry and exit points

Support and Resistance: Identify key levels where the stock's price tends to reverse. Sell puts near support levels and calls near resistance.

Moving Averages: Use crossovers of different moving averages as signals for entering or exiting positions.

Relative Strength Index (RSI): This can help identify overbought or oversold conditions, guiding your decisions on when to sell puts or calls.

Bollinger Bands: These can help identify periods of high or low volatility, which can influence option pricing.

Example: If XYZ stock has strong support at $90, you might sell puts at that level when the stock price approaches it.

Adjusting for different market conditions

Bull Markets: Consider using higher strike prices for your covered calls to capture more upside potential.

Bear Markets: Focus more on put selling at lower strikes to potentially acquire shares at better prices.

High Volatility: Take advantage of higher option premiums, but be cautious of increased assignment risk.

Low Volatility: You might need to sell options closer to the money to generate meaningful premium.

Example: In a strong bull market, instead of selling calls at $100 on a stock trading at $95, you might sell at $105 or $110 to allow for more upside.

Combining the wheel with other strategies

Collar Strategy: When holding stock, buy protective puts while selling covered calls to create a range of protected prices.

Poor Man's Covered Call: Use long-term deep in-the-money calls instead of owning the stock outright, then sell short-term calls against this position.

Diagonal Spreads: Combine options with different strike prices and expiration dates to potentially increase returns.

Laddering: Sell multiple puts or calls at different strike prices or expiration dates to diversify your positions.

Example: Instead of selling a single $95 put, you might sell puts at $90, $95, and $100 strikes to create a ladder.

Managing early assignment and dividend risk

Be aware of ex-dividend dates and adjust your strategy accordingly.

Consider closing or rolling positions before significant events to avoid early assignment.

Understand the risks of early assignment, especially with American-style options.

Example: If a stock has an upcoming $1 dividend and your short call is $0.75 in-the-money, you might want to close or roll the position to avoid early assignment.

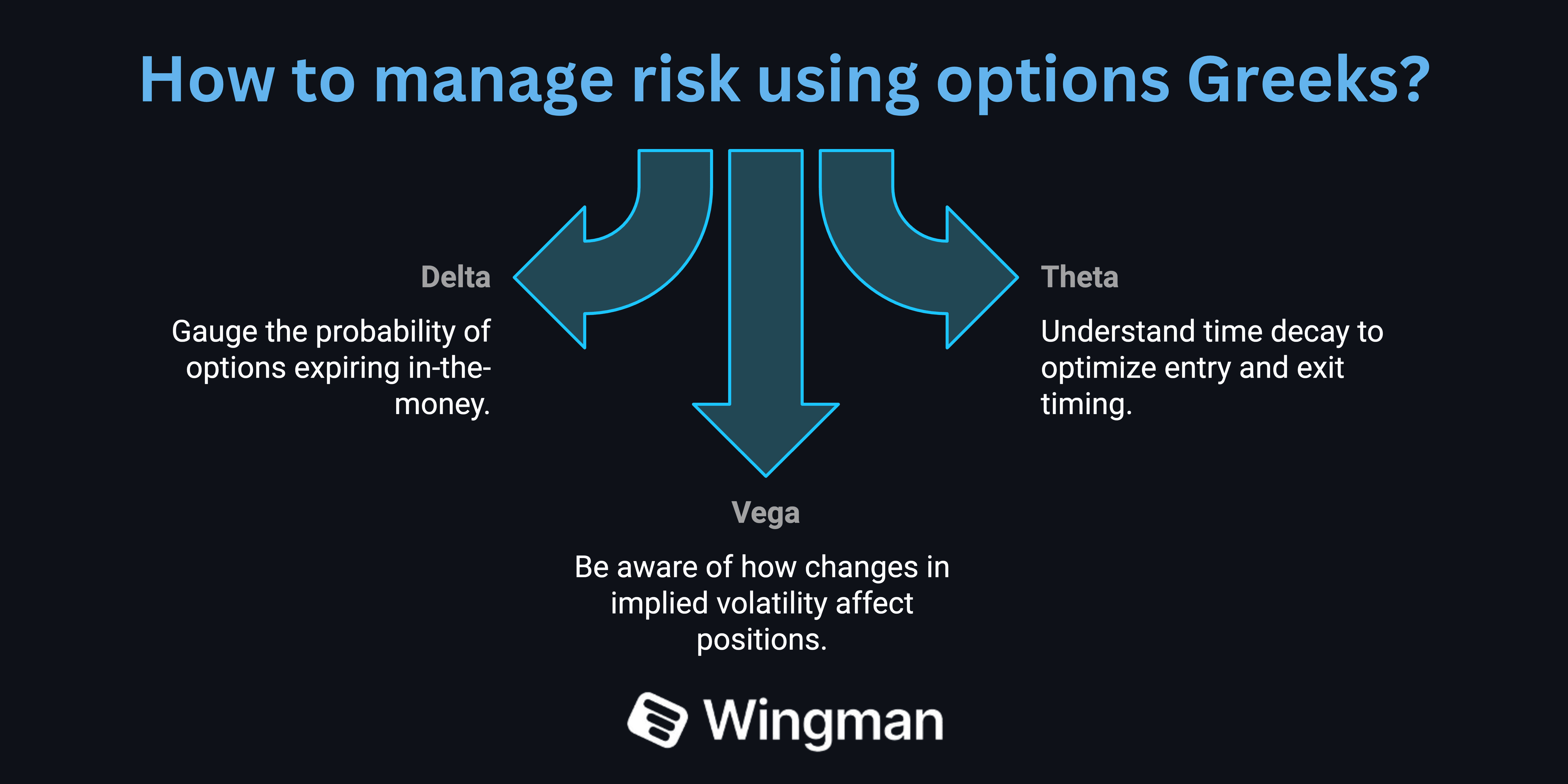

Utilizing options Greeks for more precise risk management

Delta: Use this to gauge the probability of options expiring in-the-money.

Theta: Understand time decay to optimize your entry and exit timing.

Vega: Be aware of how changes in implied volatility affect your positions.

Example: You might prefer to sell options with a delta of 0.30 or less to balance premium income with assignment risk.

By incorporating these advanced techniques, you can refine your wheel strategy to better suit your risk tolerance and market outlook.

However, remember that with increased complexity comes the need for more active management and a deeper understanding of options mechanics.

Always start small when implementing new techniques and continuously evaluate their effectiveness in your overall strategy.

Risk Management and Position Sizing

Effective risk management is crucial for long-term success with the options wheel strategy. Here are key considerations and techniques:

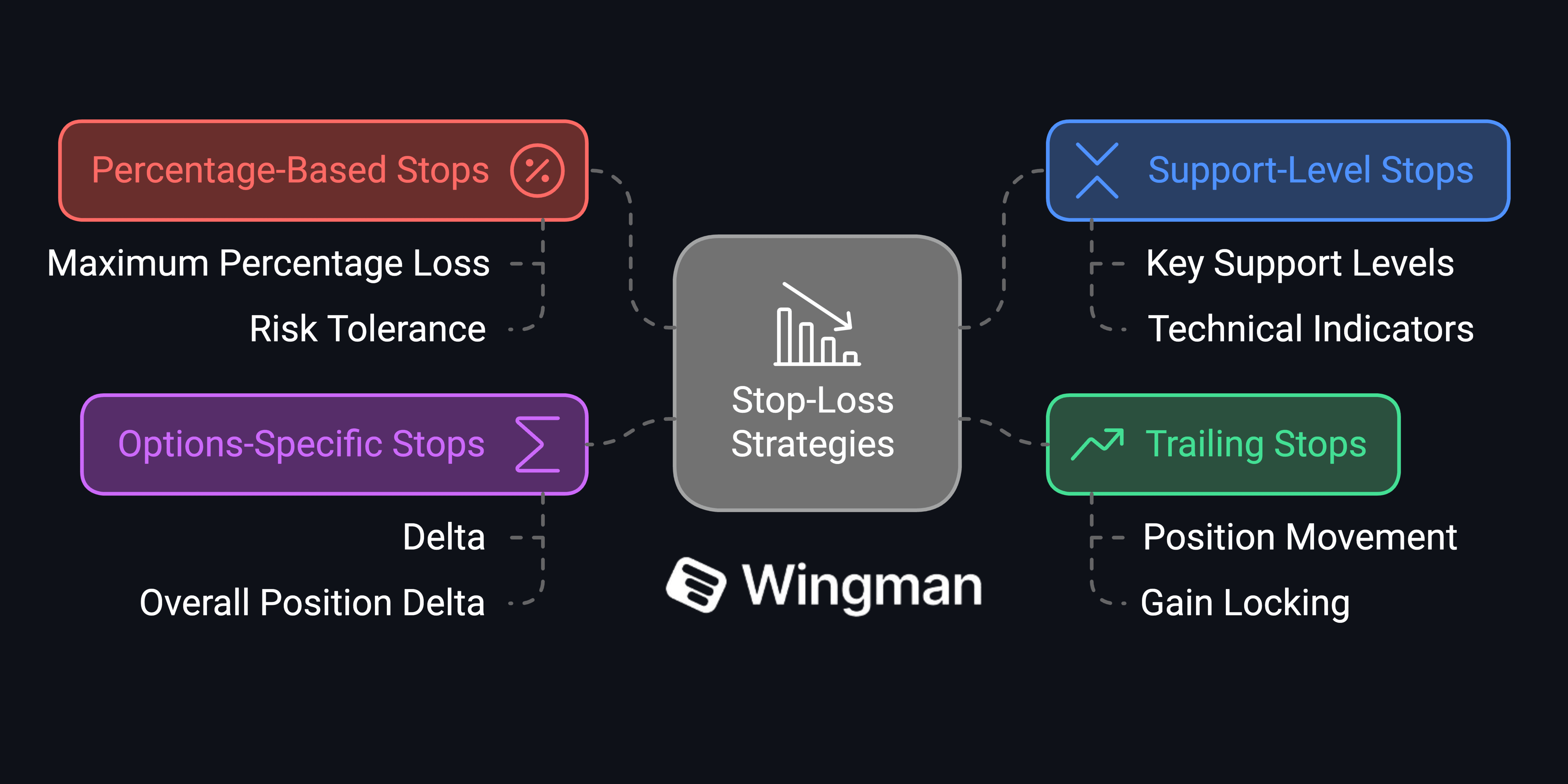

Setting stop-loss levels

Percentage-Based Stops: Set a maximum percentage loss you're willing to accept on any position.

Support-Level Stops: Use technical analysis to identify key support levels for stop placements.

Trailing Stops: Adjust your stop-loss as the position moves in your favor to lock in gains.

Options-Specific Stops: Consider using options Greeks like Delta or overall position Delta to set stops.

Implementation:

Determine your risk tolerance for each trade.

Place stop-loss orders or set alerts to monitor positions.

Be prepared to exit positions that hit your predetermined stop levels.

Example: You might set a 20% stop-loss on the underlying stock price from your entry point when assigned shares.

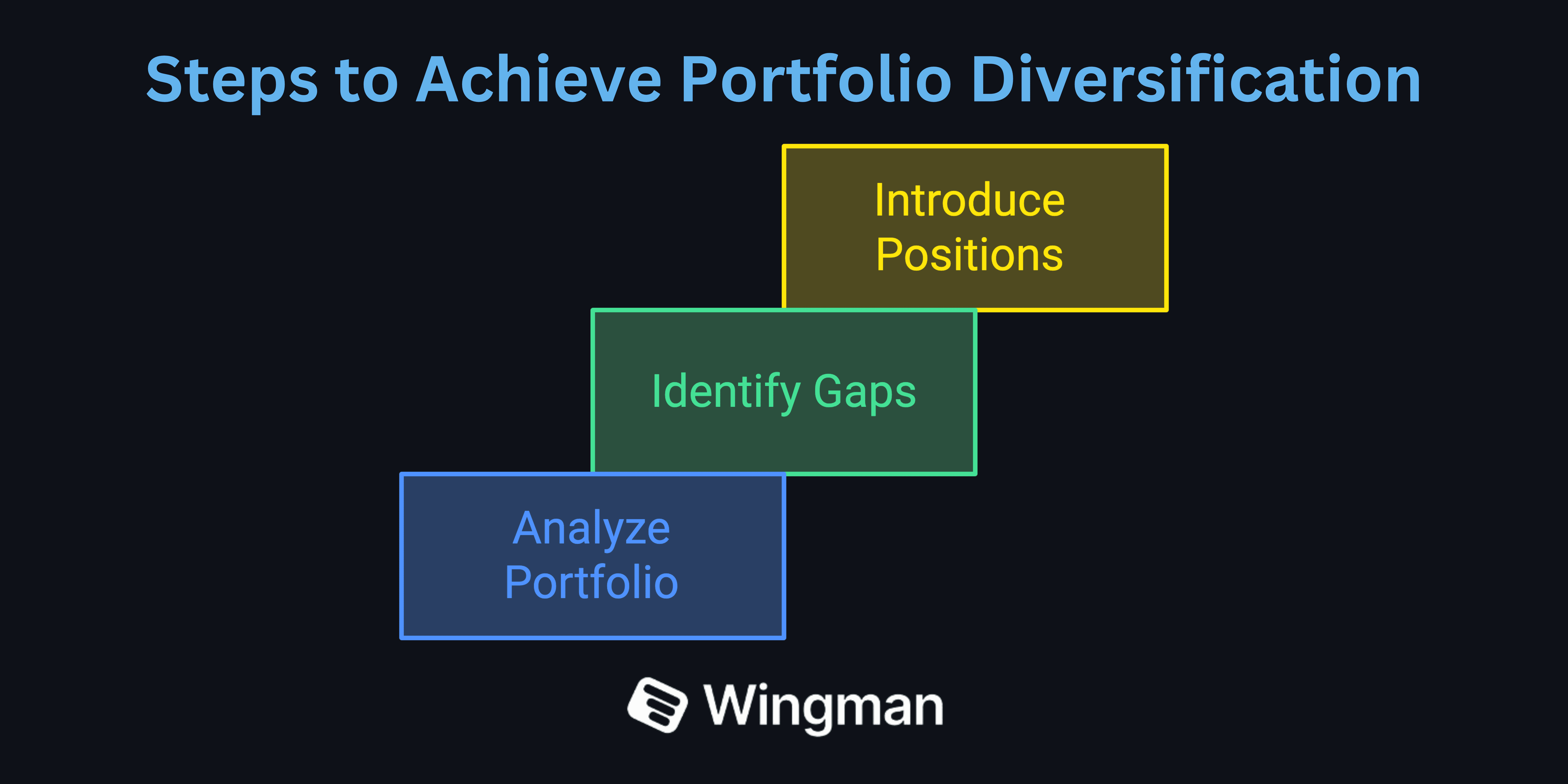

Diversification within the wheel strategy

Sector Diversification: Apply the wheel strategy across different industry sectors.

Market Cap Diversification: Include a mix of large-cap, mid-cap, and small-cap stocks.

Correlation Analysis: Choose stocks that aren't highly correlated to spread risk.

Options Diversification: Vary your strike prices and expiration dates.

Practical steps:

Analyze your current portfolio for concentration risks.

Identify underrepresented sectors or market caps.

Gradually introduce new positions to increase diversification.

Example: Instead of running the wheel on five tech stocks, you might choose one each from tech, healthcare, finance, consumer goods, and energy sectors.

Managing overall portfolio risk

Position Sizing: Limit the size of any single position relative to your total portfolio.

Beta-Weighted Delta: Use this metric to understand your portfolio's overall market exposure.

Stress Testing: Simulate various market scenarios to assess potential portfolio impacts.

Regular Rebalancing: Periodically adjust your positions to maintain desired risk levels.

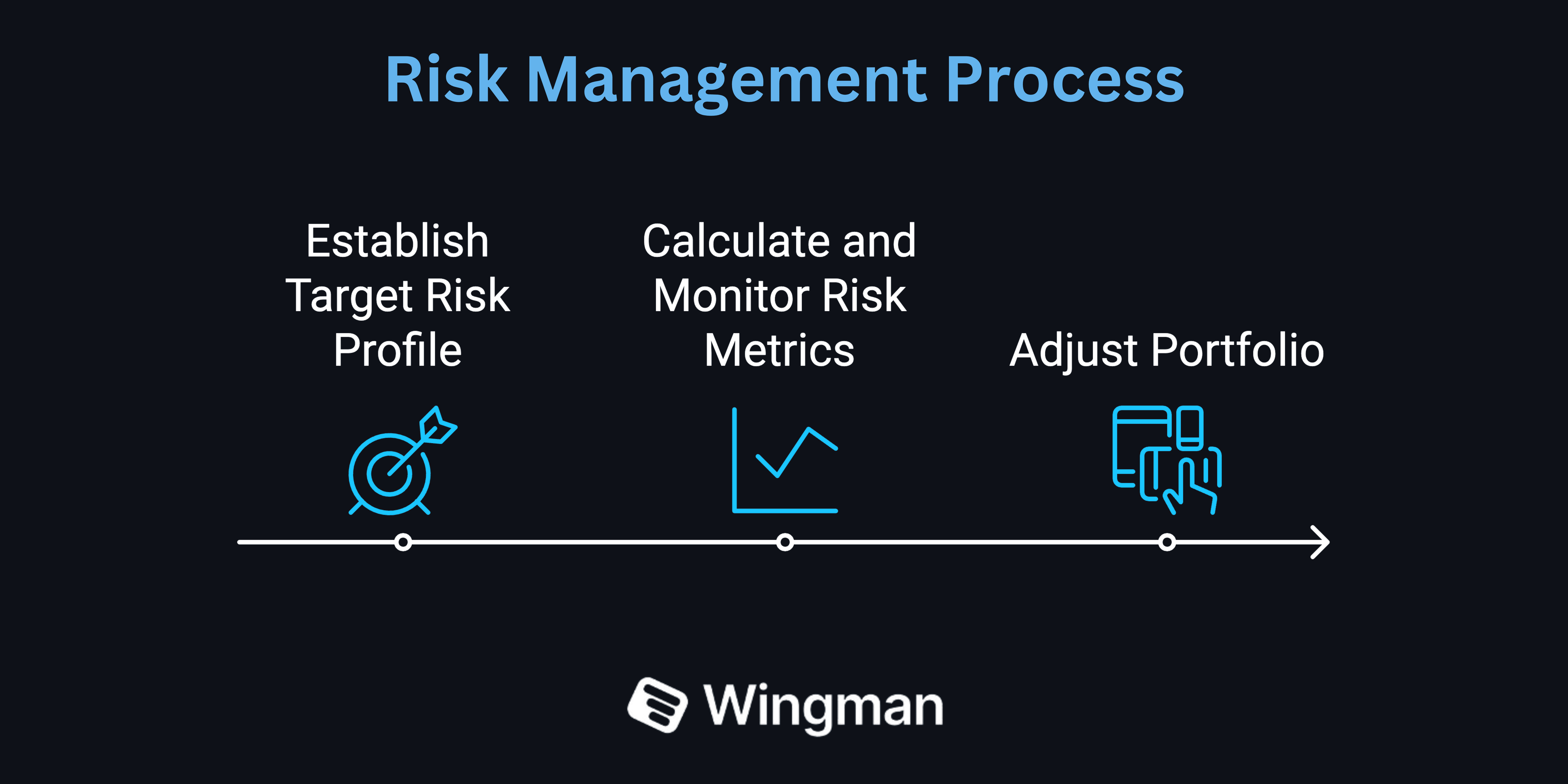

Risk management process:

Establish a target risk profile for your entire portfolio.

Regularly calculate and monitor your portfolio's risk metrics.

Make adjustments as needed to align with your risk targets.

Example: You might limit each wheel strategy position to no more than 5% of your total portfolio value.

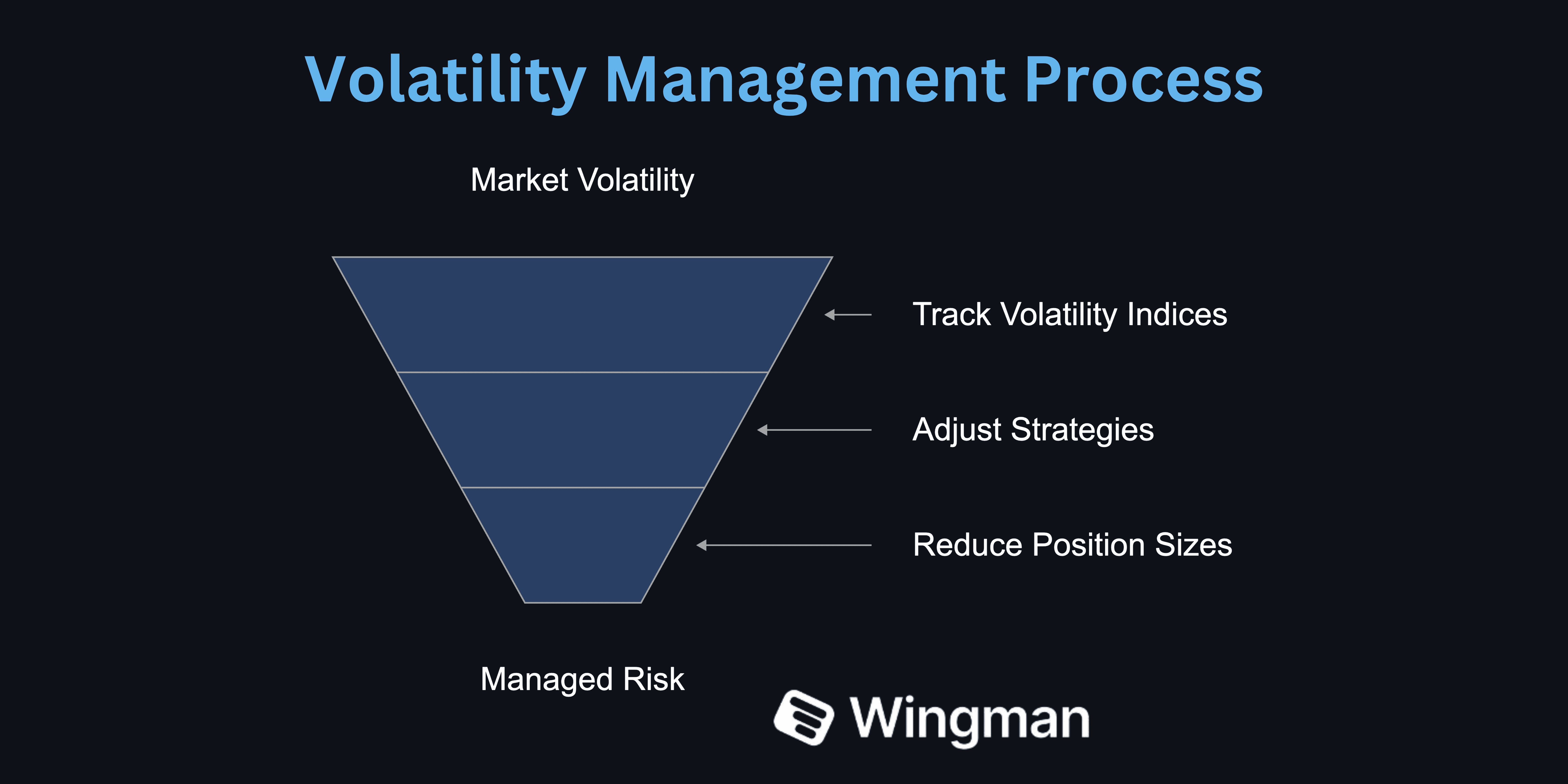

Monitoring and adjusting for market volatility

Implied Volatility (IV) Analysis: Be aware of changes in IV and how it affects option pricing.

Volatility-Based Position Sizing: Adjust position sizes based on current market volatility.

Volatility Skew: Understand how volatility differs across strike prices and use this in your strategy.

Volatility management:

Track overall market volatility indices (e.g., VIX).

Adjust your strategy during high volatility periods (e.g., selling further OTM options).

Consider reducing position sizes when volatility spikes to manage risk.

Example: During periods of high market volatility, you might reduce your typical position size by 25-50% to account for increased risk.

By implementing these risk management techniques, you can protect your portfolio from significant drawdowns and ensure that no single position or market event can severely impact your overall strategy.

Remember, consistent profitability in options trading often comes from effective risk management rather than chasing high returns.

Always prioritize capital preservation and sustainable growth over short-term gains.

Tax Implications of the Wheel Strategy

Understanding the tax implications of the options wheel strategy is crucial for optimizing your after-tax returns. Here's what you need to know:

Understanding options taxation

Short-Term vs. Long-Term Capital Gains: Most options trades result in short-term capital gains or losses, taxed at your ordinary income rate. However, stock held for over a year may qualify for long-term capital gains rates.

Qualified vs. Non-Qualified Dividends: Holding periods for stock ownership can affect dividend tax treatment. Qualified dividends are taxed at lower rates.

Wash Sale Rules: Be aware of these rules when re-entering positions to avoid tax complications.

Key points:

Premiums received from selling options are not taxed immediately.

Gains or losses are realized when the option is closed, expires, or is assigned.

The holding period for stock acquired through assignment starts on the purchase date, not the option sale date.

Example: If you sell a put option for $200 premium and it expires worthless, you'll report $200 of short-term capital gain.

Tax efficiency considerations

Tax-Loss Harvesting: Strategically realize losses to offset gains.

Long-Term Capital Gains: Consider holding assigned stocks for over a year to qualify for lower long-term capital gains rates.

IRA Considerations: Using the wheel strategy in an IRA can simplify tax reporting but may have contribution limit implications.